- Synaptic Finance

- Posts

- Stopping Payments Fraud Before It Starts

Stopping Payments Fraud Before It Starts

How AID:Tech Uses Blockchain to Fix Broken Payment Systems

“Follow the money, in real time.”

If you sent $1 million in subsidies today, could you prove where every cent is right now?

For most government agencies, non-governmental organizations (NGOs), and enterprise social responsibility departments, the honest answer is no. They can tell you where the money was sent. They can point to the initial bank account or the prime recipient who received the lump sum. However, once those funds enter the complex ecosystem of sub-grantees, local vendors, and individual beneficiaries, the trail goes cold.

This visibility gap is the root of almost all payment fraud. It is the “dark matter” of the financial world. We know it exists because of the massive amounts of money that disappear every year, but we cannot actually see it happening until it is too late. This is the era of Pay and Chase. This reactive, legacy model involves distributing funds first and then spending millions of dollars on audits later. The goal is to catch bad actors after the money has already been spent on luxury goods, diverted to offshore accounts, or simply vanished.

At AID:Tech, we believe the “Pay and Chase” model is a relic of the past. With our Kare platform, we are turning payments into data-rich, traceable events that stop fraud before it even begins.

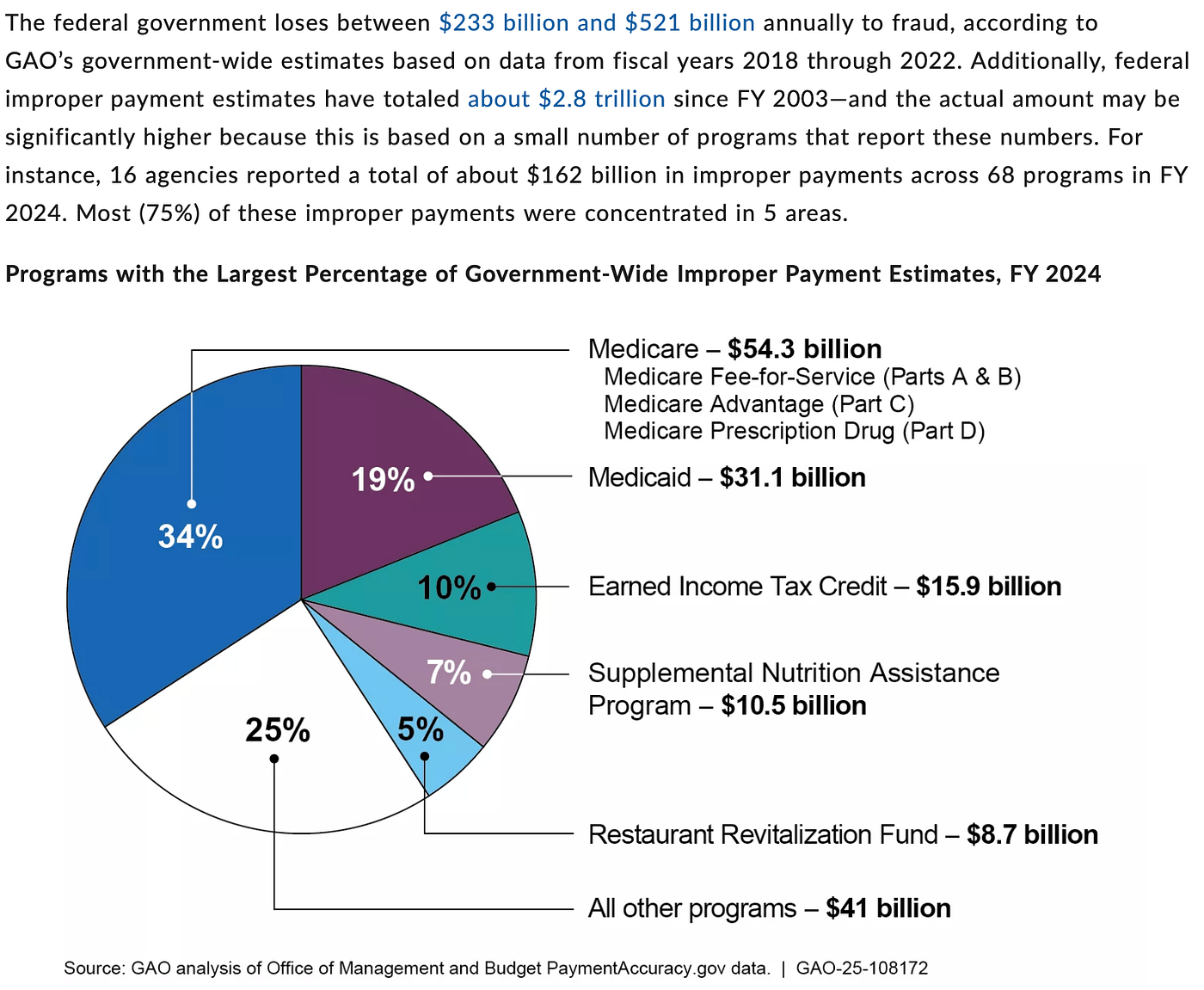

The $521 Billion Problem: The Cost of Legacy Rails

The scale of the problem is staggering. According to the U.S. Government Accountability Office (GAO), the federal government loses between $233 billion and $521 billion annually to fraud. In fiscal year 2024 alone, agencies identified $162 billion in “improper payments.” These are payments that should not have been made at all or were made in the incorrect amount.

These losses are not just abstract numbers on a balance sheet. They represent hungry families who do not get fed, patients who lose access to medicine, and a fundamental erosion of public trust. Traditional disbursement systems rely on outdated mechanisms:

Unrestricted Cash: Once a wire transfer or ACH payment hits a recipient’s account, it is “blind.” The issuing agency has no technical way to ensure the money is spent on rent rather than at a casino.

Delayed Auditing: Most government audits happen 12 to 24 months after the money is spent. By that time, the funds are unrecoverable.

Identity Vulnerability: Reliance on self-reported data and easily forged documents leads to “ghost recipients” and identity theft.

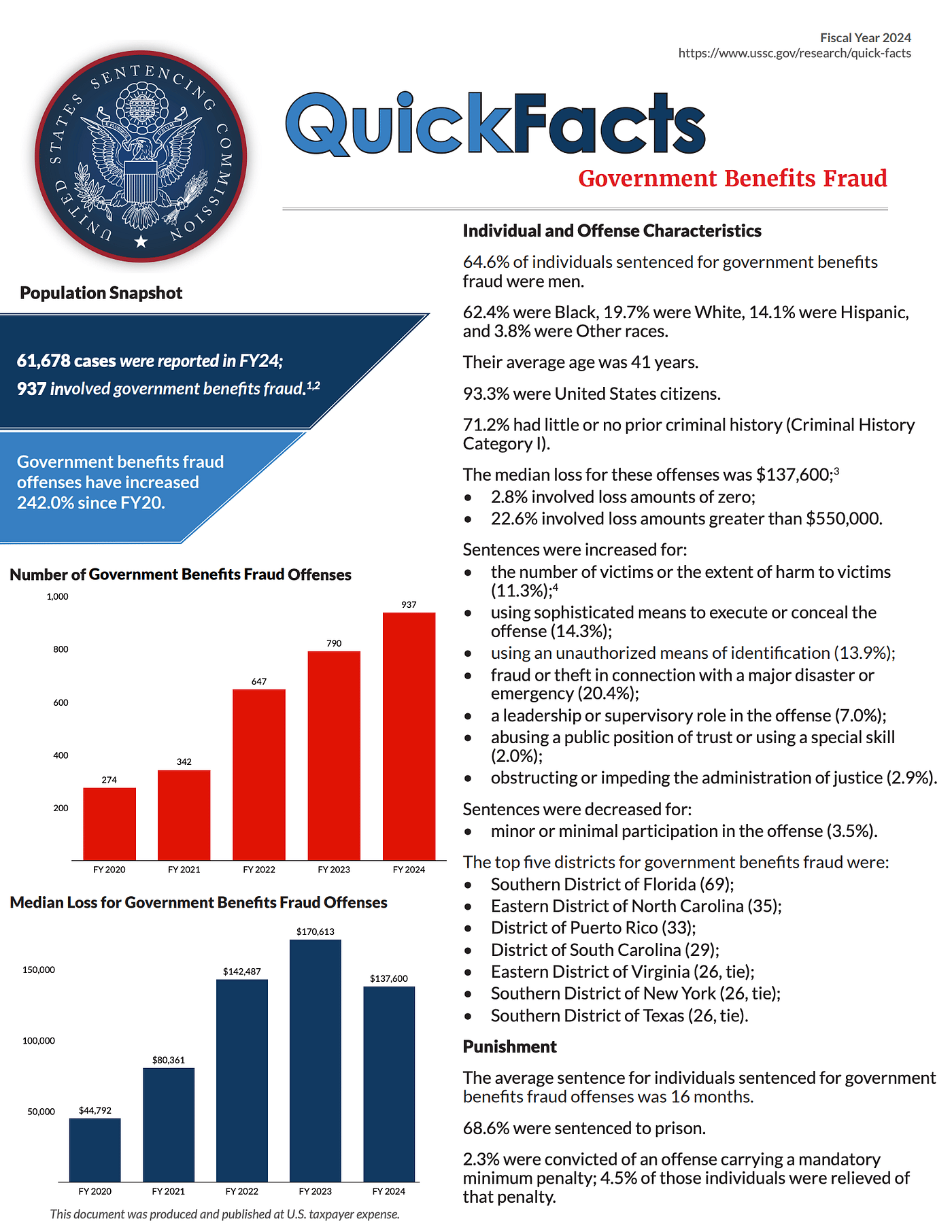

Source: United States Sentencing Commission

For state and federal bodies, the return on investment (ROI) of fixing these “leaky rails” is immediate. If a state agency processes $1 billion in annual benefits and has a 7% fraud rate (the high end of the GAO average), organisations like AID:Tech could potentially save that single agency $70 million every year.

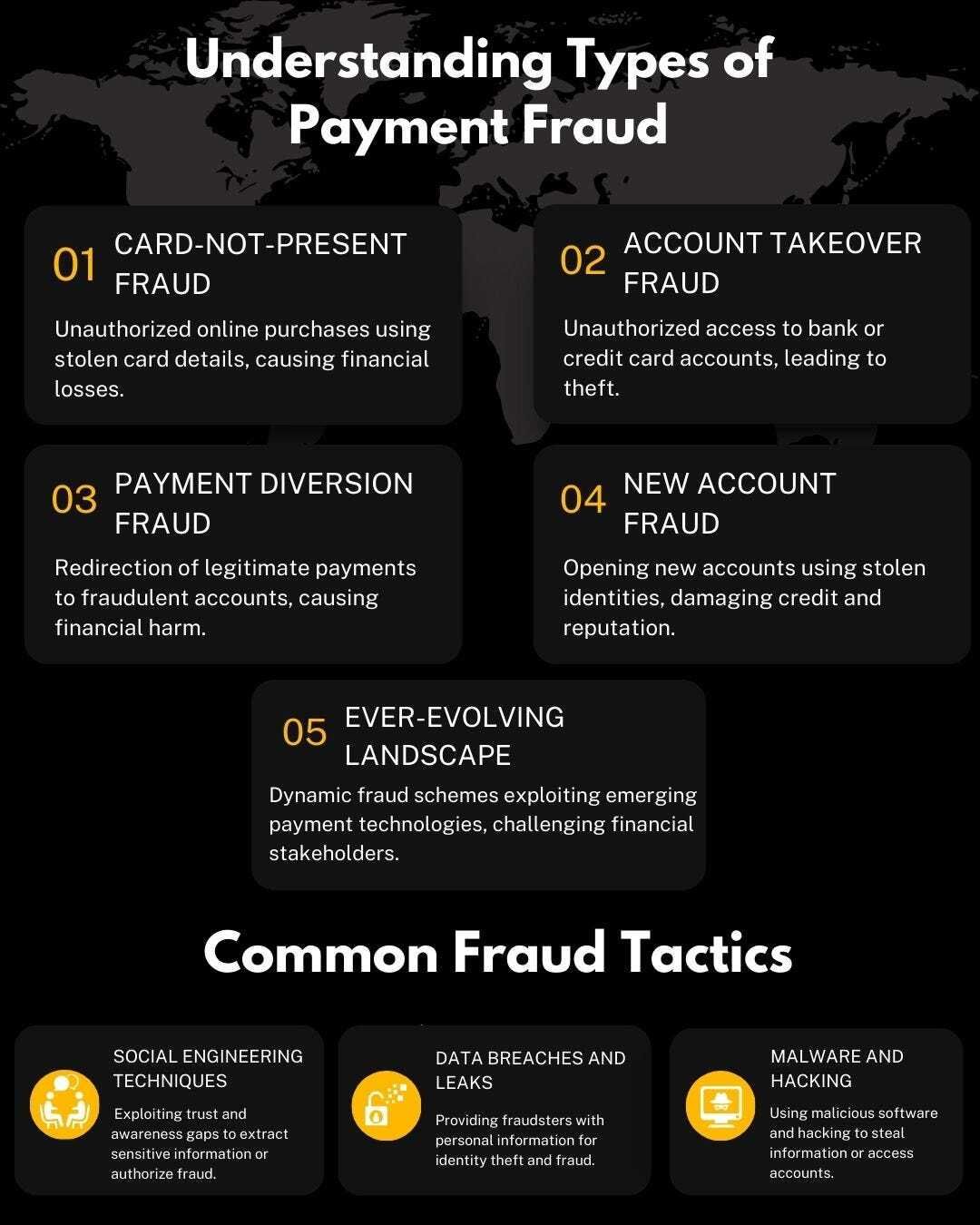

Source: i-exceed

The Kare Solution: Transparency Without Surveillance

When people hear “traceable payments” or “blockchain,” they often worry about privacy. There is a fear that the government will be “spying” on every cup of coffee a citizen buys. At AID:Tech, we have built the Kare platform with Privacy-by-Design at its core.

Our goal is to verify that the rules of the program are followed, not to monitor the lives of the individuals. We achieve this through several layers of advanced technology:

1. Zero-Knowledge Proofs (ZKP)

We use a cryptographic technique called Zero-Knowledge Proofs. This allows a user to prove something is true (for example, “I am over 21” or “I have a valid housing voucher”) without revealing the underlying sensitive data. The system confirms the validity of the claim without the administrator ever seeing the personal details.

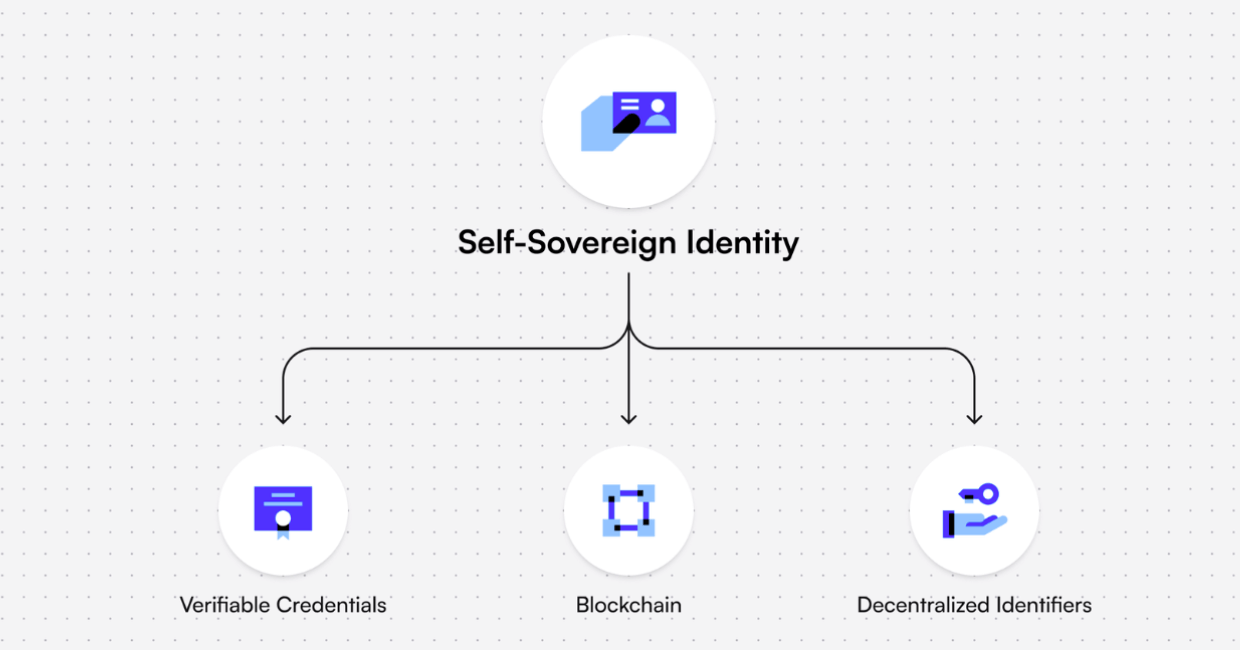

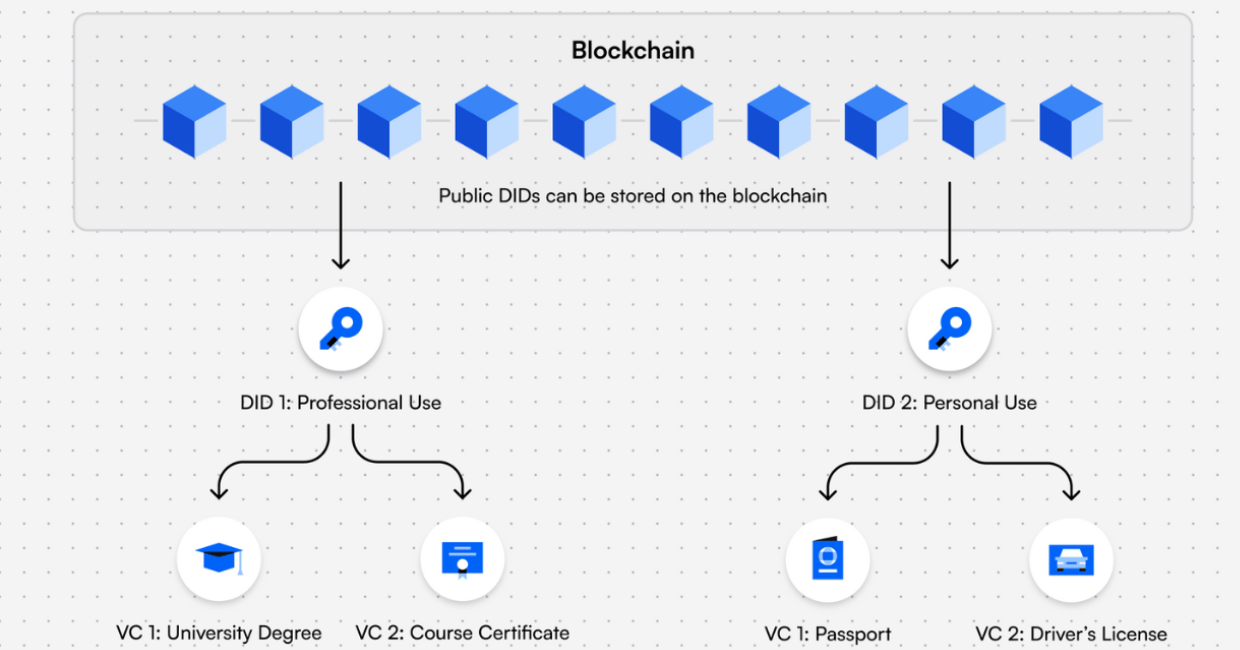

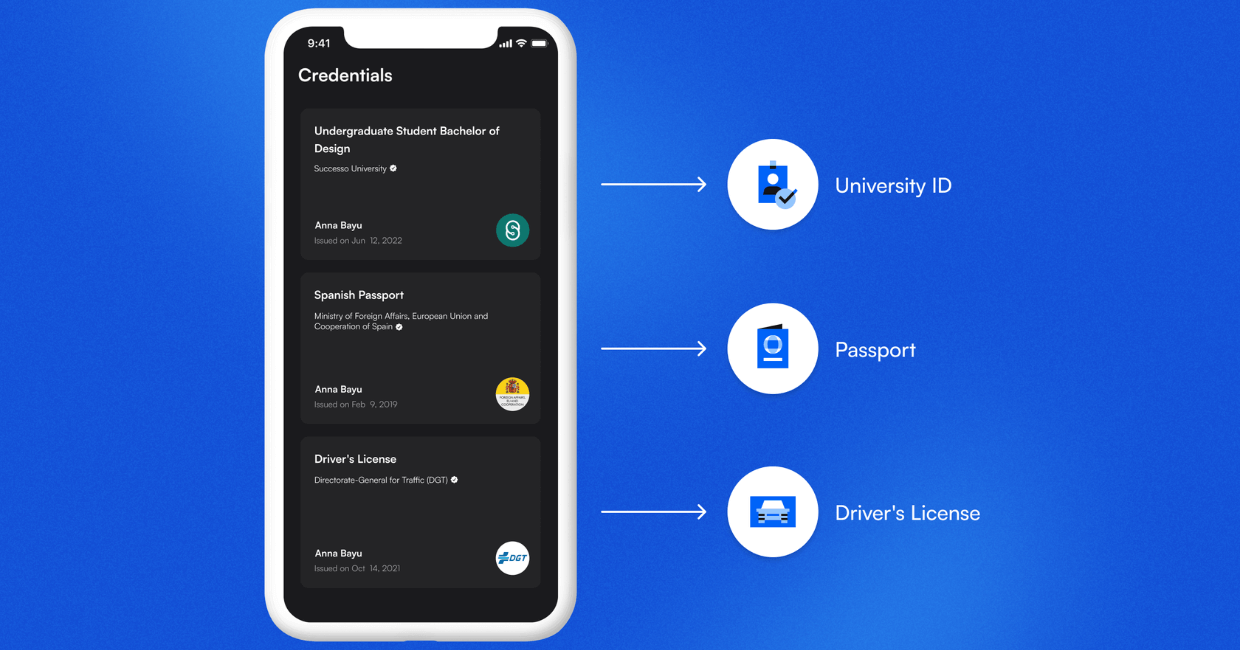

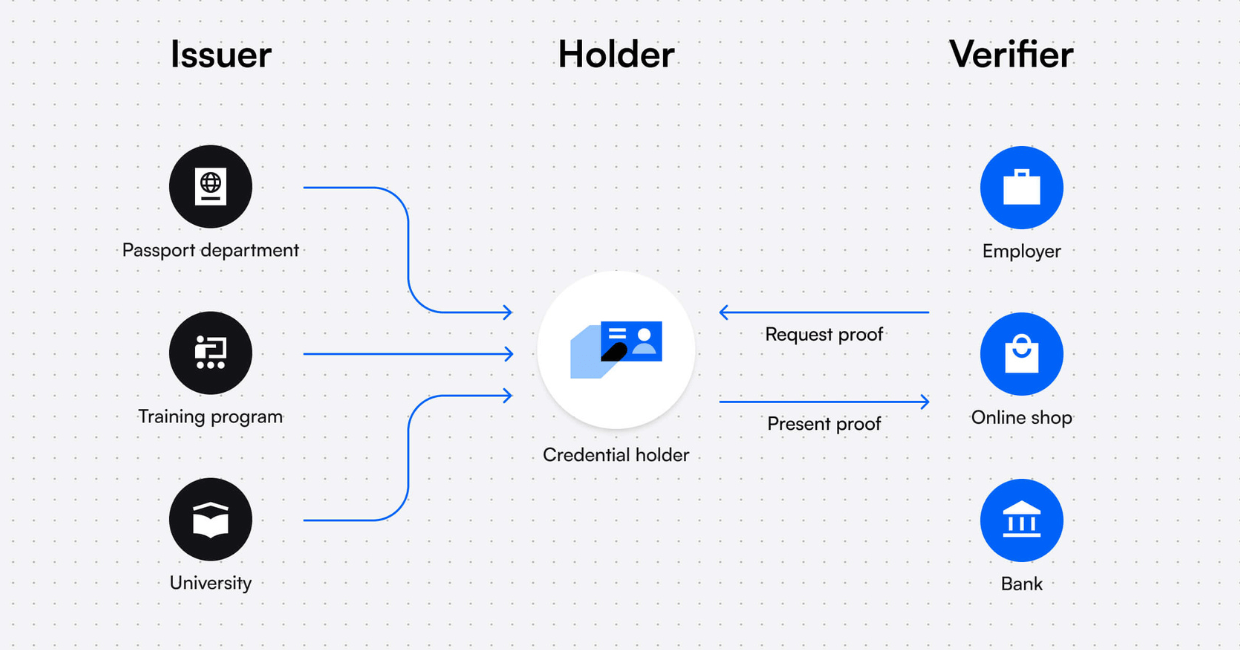

2. Decentralized Identity (DID)

Instead of a central government database that holds all your personal information (a prime target for hackers), Kare uses Decentralized Identifiers. This gives the user control over their own data. They only share what is necessary for a specific transaction.

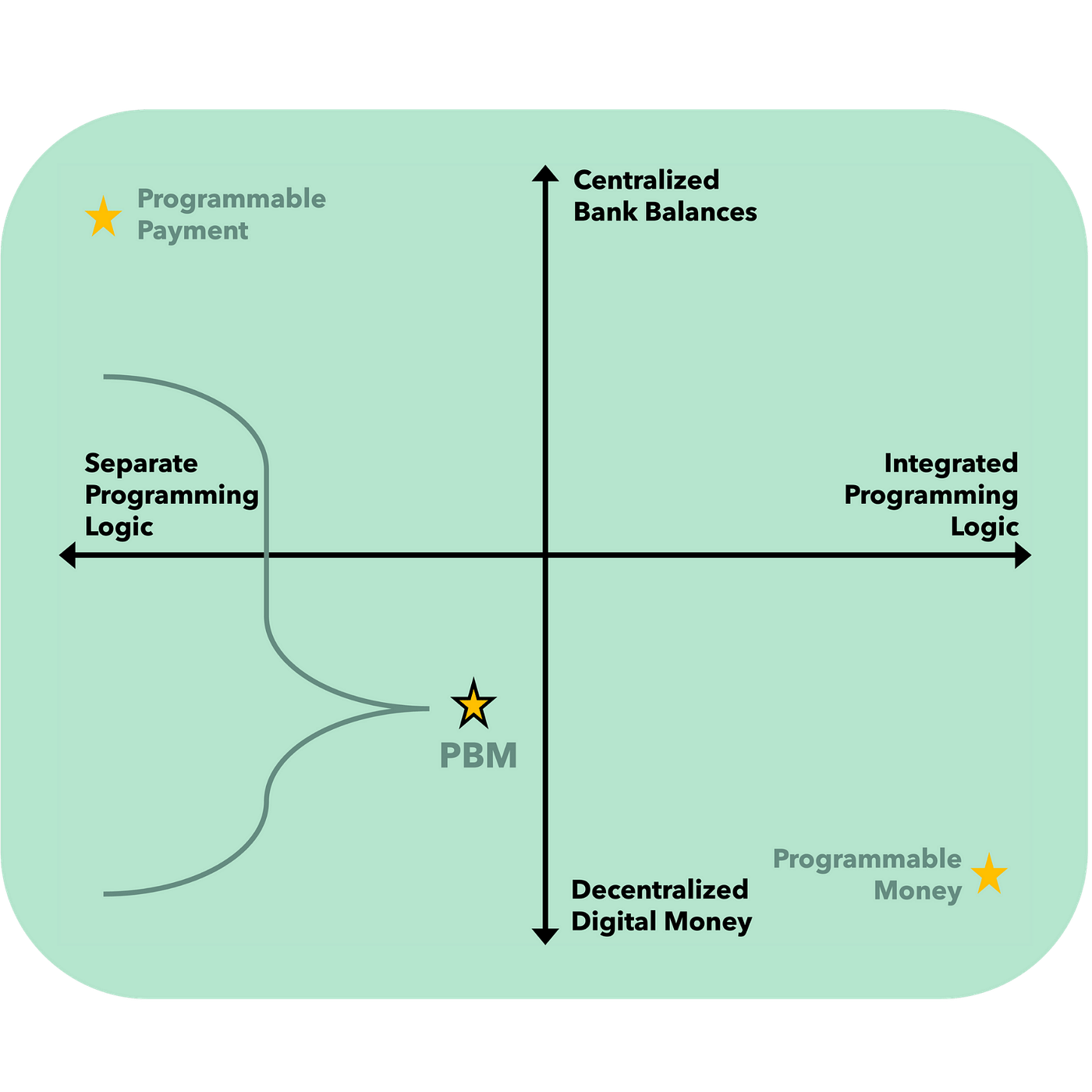

3. Purpose-Bound Money

We do not track “you.” We track the “intent” of the dollar. By using programmable stablecoins, we attach specific logic to the digital currency itself. If a dollar is designated for “nutritional support,” that dollar “knows” it can only be redeemed at a grocery store. This ensures the integrity of the program without needing to keep a file on the recipient’s personal habits.

Programmable Guardrails: Stopping the Purchase of Alcohol, Tobacco, and Firearms

The most effective way to prevent fraud and misuse is to move the enforcement of policy from the “audit phase” to the “Point of Sale (POS) phase.”

The Kare platform allows agencies to issue programmable cards. These cards are linked to a smart contract on the blockchain that acts as an automated compliance officer.

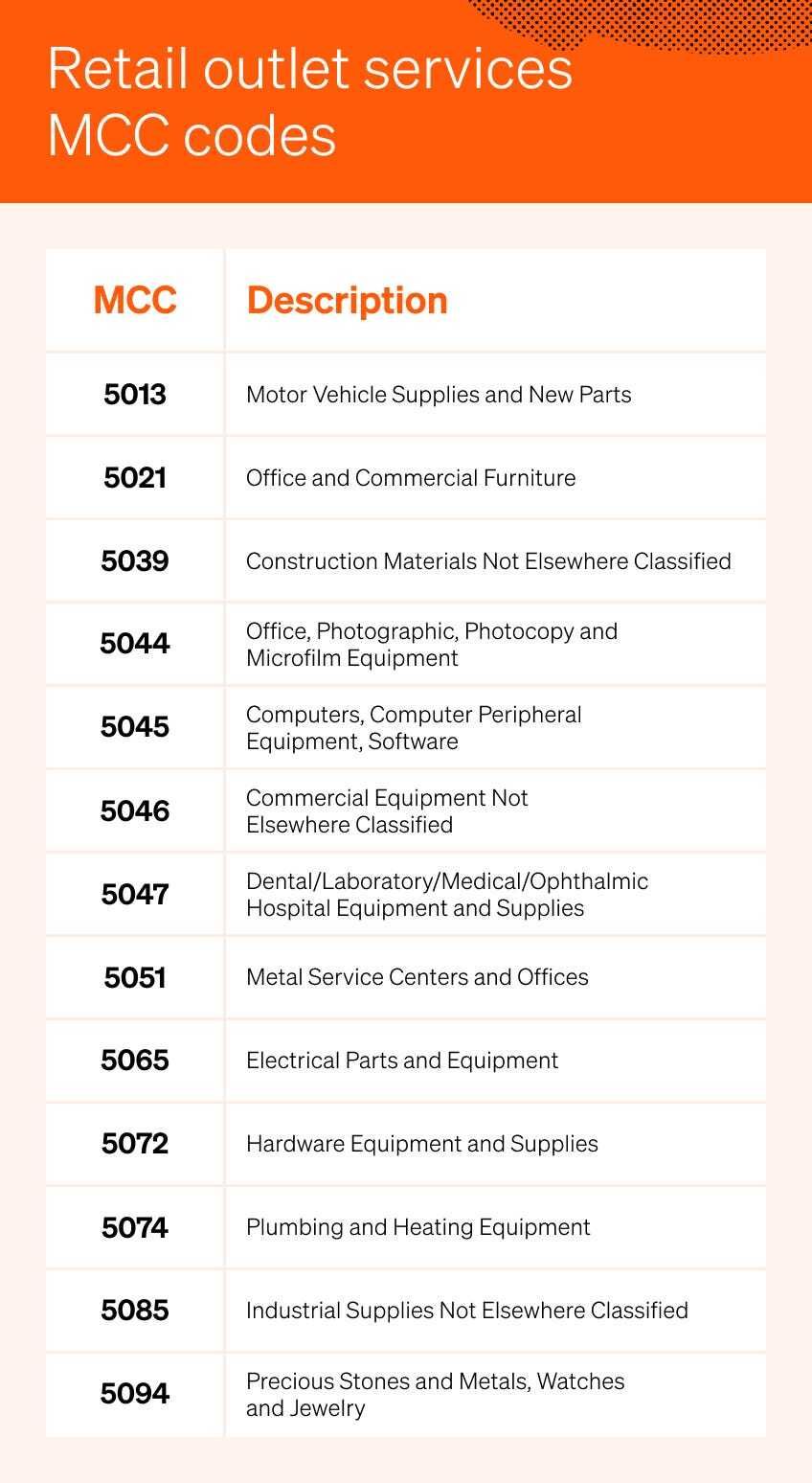

Merchant Category Code (MCC) Filtering

Every merchant that accepts card payments has an MCC. A grocery store has one code, a liquor store has another, and a gun shop has a third. AID:Tech cards can be hard-coded to automatically decline transactions at unauthorized MCCs.

Alcohol and Tobacco: If a user tries to use a social aid card at a dedicated liquor store or smoke shop, the transaction is rejected instantly. The “money” simply does not recognize that merchant as a valid destination.

Firearms and Ammunition: Ensuring that humanitarian or disaster relief funds are never used to procure weaponry is a high priority for international NGOs and federal agencies. Our platform makes this a technical certainty.

Gambling and Luxury Goods: We can restrict spending to essential categories like health, education, and housing, ensuring that taxpayer dollars fulfill their intended mission.

This system is proactive. It does not wait for a fraudster to spend the money and then try to “chase” them. It makes the misuse of funds technically impossible from the start.

Source: Investopedia

Why This Matters for the Public Sector

As we look toward the future of government efficiency, the White House Office of Management and Budget (OMB) has emphasized the need for better data sharing and identity verification to prevent improper payments. AID:Tech provides the infrastructure to meet these federal standards today.

Scalability Across All Levels

Whether it is a local municipality distributing housing vouchers or a federal agency managing disaster relief, the infrastructure is the same. The Kare platform is designed to be modular. Agencies can choose which “guardrails” they need and which categories of spending they want to allow.

Real-Time Auditing

For the administrator, the dashboard provides a level of granularity that was previously impossible. They do not just see that $1 million was spent. They see a real-time stream of data showing that 100% of those funds went to verified vendors for approved goods. This “self-auditing” nature of blockchain reduces the administrative burden and the cost of annual reviews.

Restoring Public Trust

The most significant “savings” are not just financial. When a government can prove to its citizens that fraud has been eliminated, it restores the social contract. It shows that the system works, that the vulnerable are being cared for, and that taxpayer dollars are being handled with the highest level of integrity.

The era of “Pay and Chase” is ending because it has to. As global challenges grow more complex and public budgets become more scrutinized, we can no longer afford the “fraud tax” of legacy systems.

The Kare platform offers a new way forward. By combining the security of blockchain, the precision of programmable cards, and a deep commitment to personal privacy, we are fixing the broken rails of our financial systems.

It is time to stop chasing the money and start following it in real time.