- Synaptic Finance

- Posts

- Stablecoins: The GENIUS of CLARITY

Stablecoins: The GENIUS of CLARITY

How the latest U.S. stablecoin and crypto regulations empower entrepreneurs to innovate and grow.

In July 2025, the United States enacted two landmark laws, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) and the CLARITY Act (Digital Asset Market Structure Clarity Act). These laws ushered in an unprecedented wave of regulatory certainty for the crypto and fintech industry. These laws are designed to close regulatory gaps and clearly define the rules of the game for digital assets. (See the official White House signing statement here.)

🧵 Today, on a bipartisan basis, the Senate passed its first piece of major legislation this Congress with my bill -- the GENIUS Act.

With GENIUS, the United States is one step closer to becoming the crypto capital of the world. (1/7)— Senator Bill Hagerty (@SenatorHagerty)

9:24 PM • Jun 17, 2025

My insight: This is one of the most transformative moments in fintech regulation for over a decade. The level of clarity provided removes what was once the greatest source of friction in crypto adoption—the unknown regulatory environment.

For startups of all sizes, this represents a turning point. With well-defined frameworks now in place for both stablecoins and other crypto assets, entrepreneurs can innovate with newfound confidence and legitimacy. Regulation is no longer a roadblock; it is a springboard. This is especially impactful in the context of rising global interest in decentralized finance, a sector where regulatory uncertainty has often deterred innovation.

Why the GENIUS Act Matters

The GENIUS Act establishes the first comprehensive federal framework for "payment stablecoins," digital tokens backed 1:1 by high-quality reserves like cash or U.S. Treasuries and pegged to a national currency. Until now, stablecoin issuers operated in a grey area. The GENIUS framework changes that by prioritizing consumer protection, financial stability, and responsible innovation.

Only licensed and regulated entities can now issue stablecoins in the U.S. That means startups must either obtain a license or partner with an authorized issuer. These rules are designed not to stifle innovation but to legitimize it. The Act mandates 100% reserve backing, monthly disclosures, and strict compliance with U.S. law.

By providing a clear rulebook, the GENIUS Act enables innovators to build payment solutions on top of stablecoins with confidence. Consumer trust is likely to grow, and so too are the opportunities for startups leveraging these new legally recognized digital dollars.

Moreover, the GENIUS Act strengthens America’s position in the global race for fintech leadership. While jurisdictions like Singapore and the EU have implemented frameworks like Project Orchid and MiCA, the GENIUS Act signals that the U.S. will not be left behind.

My Insight: The Dawn of Transparent Money

The mandatory public disclosures in the GENIUS Act are being framed as a compliance burden, but that misses the bigger picture. This is the dawn of truly transparent money. For the first time, we have a payment rail where any user can verify the system's solvency in real-time. Compare that to the opacity of the traditional banking and correspondent banking systems. This isn't just about making stablecoins safer; it's about making them a fundamentally superior and more trustworthy infrastructure for global commerce. Startups that build on this transparency will win.

What the CLARITY Act Unlocks

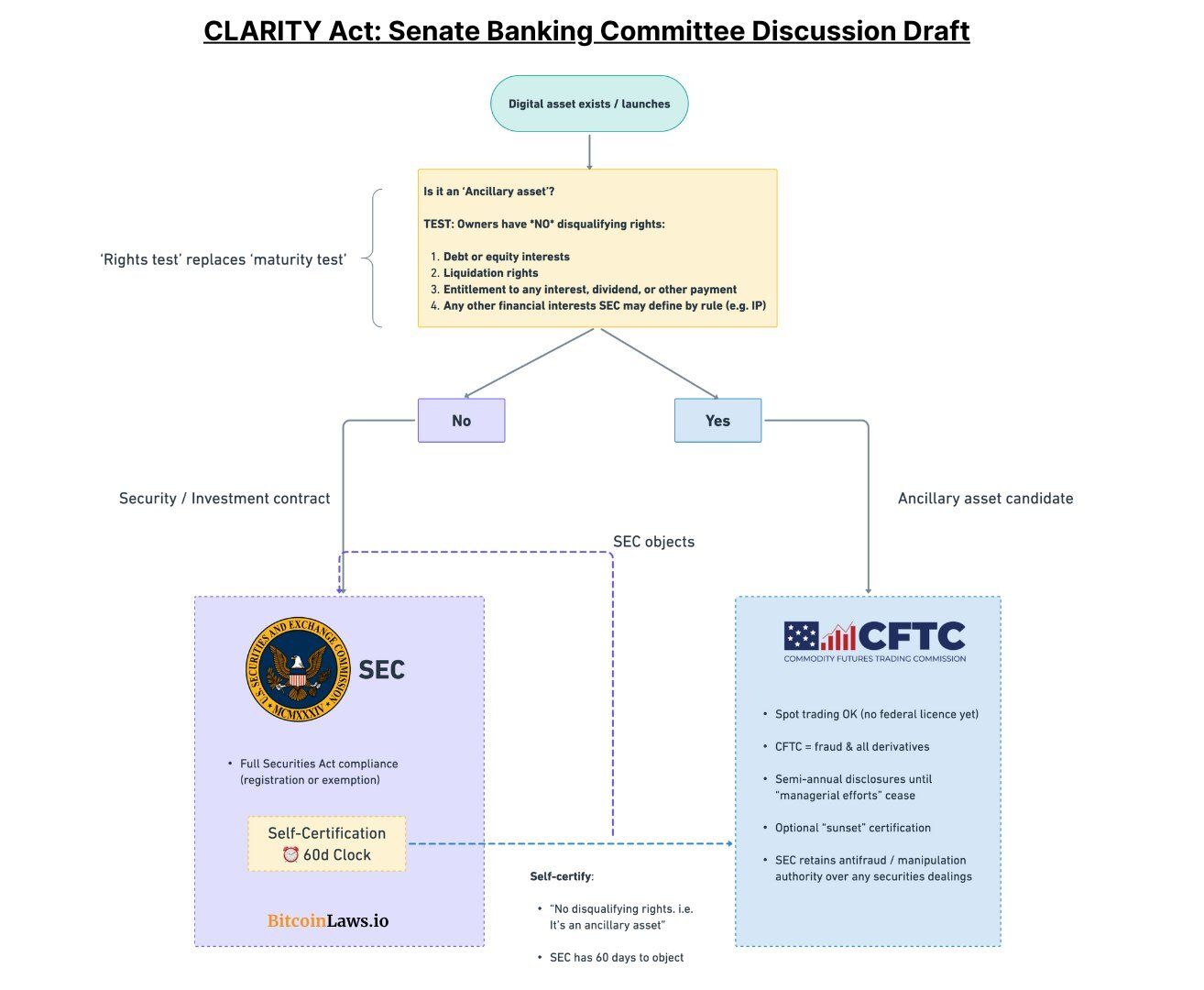

Working in tandem with GENIUS, the CLARITY Act tackles the broader crypto landscape. For years, U.S. blockchain startups have been held back by one central question: is my token a security? This act provides the answer.

CLARITY defines clear jurisdictional boundaries between the SEC and the CFTC, ending the confusion over who regulates what. It also introduces tailored registration pathways depending on the nature of the token, whether it’s a security, a commodity, or something else entirely.

Startups now have a framework they can work within. Rather than fearing enforcement actions or limiting U.S. user access, founders can build with clarity. It’s a signal to the world that America is ready to lead on digital asset innovation.

The CLARITY Act also brings the U.S. closer to models being developed in the UK FCA and Abu Dhabi Global Market, aligning global efforts to regulate and integrate digital assets into the financial system.

Why This Matters for Startups

Together, GENIUS and CLARITY level the playing field. Offshore stablecoin providers can no longer operate in the U.S. without oversight, reducing the regulatory arbitrage that disadvantaged domestic players.

This new regime encourages mainstream institutions to participate, creating more partnership opportunities for startups. Interest from banks, fintechs, and legacy payment companies has surged since GENIUS passed. Stablecoin market cap is climbing, and even traditionally cautious players like Western Union are now embracing digital currency innovation.

WisdomTree rebranded its stablecoin to USDW. PayPal launched PYUSD with full regulatory compliance. Even Amazon and JD.com have begun exploring private stablecoins for customer rewards and payments.

My insight: The endorsement from legacy giants validates the GENIUS and CLARITY Acts as enablers of real business innovation, not merely regulatory checkboxes. This is the ecosystem evolution we've been waiting for.

This shift signals one thing: startups can now build with stablecoins as essential infrastructure. No more grey areas. No more compliance roulette. Just clear, actionable rules.

More importantly, these changes make it easier for smaller players to partner with regulated institutions. A startup no longer needs to build a bank from scratch; it can tap into a regulated network of custodians, on/off-ramp providers, and compliance tools.

How Startups Can Issue Their Own Stablecoin

The GENIUS Act has made it possible for startups of any size to launch a stablecoin legally and quickly. Below are five of the most relevant pathways to doing just that:

My Insight: Focus on Your Core Mission, Not Compliance

The single biggest strategic decision for a founder in this space is "Build vs. Partner." The new laws make building your own licensed issuance vehicle incredibly complex and expensive. For 99% of startups, the answer is clear: partner. Your competitive advantage isn't going to come from running a compliant financial institution. It will come from solving a unique problem for your users. Let partners like Brale or Paxos handle the regulatory overhead so you can focus entirely on product, growth, and your core mission. Don't build the plumbing; build the experience.

Partner with a Licensed Issuer – Brale

Startups that don’t want to undergo licensing themselves can work with regulated partners. Brale is one such provider. It offers a Stablecoin-as-a-Service platform for brands and projects wanting to issue their own digital dollar.

A prime example is the Glo Dollar, a charitable stablecoin launched by the nonprofit Glo Foundation. Brale handled issuance and compliance, while Glo focused on its mission. For startups, Brale offers the same: fast, legal stablecoin issuance on multiple chains.

Use a Federally Chartered Bank – Anchorage Digital

Anchorage Digital, a federally chartered crypto bank, launched a stablecoin issuance platform following the GENIUS Act. Their first client was Ethena, a startup now offering a compliant, U.S.-issued stablecoin.

Anchorage provides custody, liquidity, and compliance so founders can focus on product and go-to-market. This is ideal for fintechs looking for institutional-grade infrastructure.

Go with a Proven SCaaS Provider – Stably

Stably has helped launch over 15 stablecoin projects across multiple chains. Their platform handles everything: smart contracts, fiat reserves, compliance advisory, and audits.

With GENIUS now in effect, Stably is onboarding a wave of corporate and startup clients who want branded stablecoins. Launching takes weeks, not months. They also provide support for KYC/AML compliance and liquidity setup.

Stably's approach is particularly useful for global startups that want multi-chain deployments across ecosystems like Ethereum, Polygon, and Solana.

White-Label via a Trust Company – Bastion

Bastion offers white-label stablecoin issuance under a New York Trust license. It allows clients to customize everything: branding, reserve management, on/off ramps, and chain integration.

Startups retain brand ownership and user experience, while Bastion handles the regulatory heavy lifting. It’s a smart route for companies with unique compliance requirements or non-standard use cases.

Partner with a Custodian – Paxos (PayPal Model)

When PayPal launched PYUSD, it didn’t issue the token itself. Instead, it partnered with Paxos, a NYDFS-regulated trust company that manages reserves and compliance.

This model is now replicable for startups. You can integrate a stablecoin deeply into your platform without taking on direct regulatory risk. Paxos and similar firms are opening up this playbook to more companies.

This is similar to Stripe’s approach for crypto payments, where startups can enable new payment rails through established partners.

Why Stablecoins Are Now a Competitive Advantage

Stablecoins enable real-time settlement, 24/7 transaction capabilities, and programmable financial interactions. But until now, startups hesitated due to legal uncertainty.

With the GENIUS and CLARITY Acts, that hesitation is gone. A startup can now:

Launch a stablecoin to reduce payment costs,

Reward users with branded digital dollars,

Offer instant settlement for global remittances,

Build new DeFi primitives or consumer apps on top of regulated currency.

Regulation has turned from a barrier into a moat. Compliant startups can now scale faster, partner with institutions, and win customer trust.

The ability to program compliance into token logic, offer instant distribution, and reduce reconciliation costs will also impact adjacent sectors such as supply chain finance, carbon markets, and impact funding.

Conclusion: From Grey Zones to Green Lights

This is a new era. Startups are no longer shut out of digital finance due to uncertainty. Thanks to the GENIUS and CLARITY Acts, the U.S. has created the clearest legal framework in the world for stablecoins and digital assets.

The implications are massive. Entrepreneurs can now:

Build with confidence,

Issue stablecoins via regulated partners,

Tap into institutional-grade infrastructure,

Partner with banks and fintechs without legal risk.

Regulation and innovation are no longer at odds. Done right, they are partners in driving a new financial future.

At Synaptic Finance, we believe that compliant innovation is the next frontier. For startups that understand this shift and act fast, the opportunity is enormous. The rules are here. The rails are live. The only question left is: What will you build on them?