- Synaptic Finance

- Posts

- It’s Not a Stablecoin: Inside the Rise of the Bank Deposit Token

It’s Not a Stablecoin: Inside the Rise of the Bank Deposit Token

The End of the "Walled Garden"

Jamie Dimon has famously threatened to fire any trader who bought Bitcoin. Yet, under his watch, JPMorgan has processed over $1.5 trillion in notional value on blockchain rails. With the recent rebrand of its blockchain unit Onyx to Kinexys and a stunning pivot to testing on public blockchains, the world's largest bank is no longer just experimenting with crypto; they are trying to become the operating system for it.

This paradox, a CEO who dismisses "crypto" as a speculative mania while building the most advanced blockchain infrastructure in banking, highlights a critical distinction that most observers miss. The institutional revolution isn't about Bitcoin, or even about "assets" in the traditional sense. It is about rewiring the commercial bank money that powers the global economy.

The launch of the JPM Coin and the Bank Deposit Token (JPMD) marks the end of the pilot phase. We are witnessing the emergence of a new asset class that looks like a stablecoin on the surface but behaves like a bank account under the hood. This distinction is not semantic; it is structural, and it will define the next decade of digital finance.

From Onyx to Kinexys: More Than a Name Change

For years, JPMorgan's blockchain efforts lived under the brand Onyx. It was a fitting name for the early era of enterprise blockchain: solid, valuable, but static and somewhat opaque. The rebrand to Kinexys signals a profound shift in intent. Derived from "kinetic," it implies movement, energy, and active transfer. It suggests a system that is no longer just a vault for recording assets, but a highway for moving them.

This isn't marketing fluff. The numbers are real. Kinexys is now processing over $2 billion in daily transaction volume, largely for cross-border payments and repo market settlements. While this is a fraction of the $10 trillion JPMorgan moves daily, it is production-grade infrastructure moving real value at a scale that dwarfs most DeFi protocols.

The Killer App: Unfreezing the Repo Market

To understand the "why" behind Kinexys, look at the Repo (Repurchase Agreement) market. This is the plumbing of the financial system, where banks lend trillions overnight using treasuries as collateral. In the legacy world, this market effectively closes on Friday afternoon. If a corporate treasurer or a bank needs liquidity at 2:00 AM on a Saturday to meet a margin call or seize an opportunity, they are out of luck. Their billions in capital are frozen until Monday morning.

Kinexys solves this with intraday repo. By tokenizing both the collateral (Treasuries) and the cash (JPM Coin), JPMorgan allows clients to borrow billions for hours rather than days, settling instantly on the blockchain. This unlocks massive capital efficiency. It allows money to move as fast as information, 24/7/365. It turns "idle capital" into "working capital." It is the infrastructure for the "Always-On" economy.

The Product: What is a Bank Deposit Token (JPMD)?

To understand why this matters, we have to define what JPMD actually is, because it fundamentally differs from the cryptocurrencies we are used to.

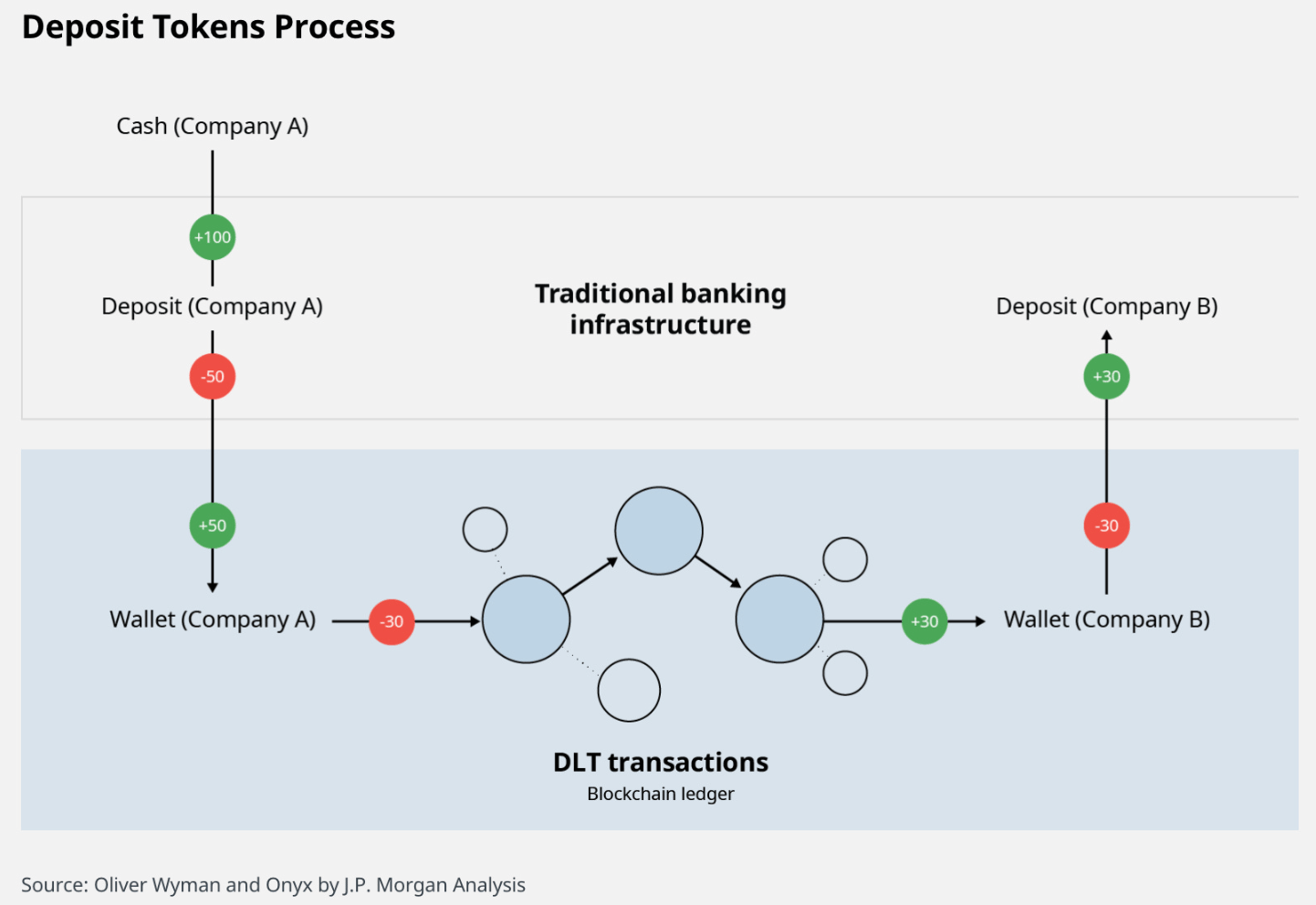

A Bank Deposit Token is a blockchain-based representation of a deposit held at a commercial bank. It is not a new asset class; it is a new format for an old asset: commercial bank money. When a client "mints" JPMD, they are effectively depositing cash into a JPMorgan account, and the bank is issuing a digital token representing that claim. When they "redeem" it, the token is burned, and the cash is credited back to their ledger balance.

This sounds simple, but it unlocks programmability. Because JPMD lives on a blockchain, it can be controlled by smart contracts, self-executing code that enforces rules.

Use Case 1: The Programmable Treasury. A multinational corporation can set a rule: "If the cash balance in our Singapore subsidiary falls below $10M, automatically sweep funds from our London account, convert them to USD, and transfer them to Singapore, but only if the FX rate is below X." This replaces manual treasury operations with automated, 24/7 logic.

Use Case 2: Atomic Settlement. In global trade, payment risk is huge. A supplier doesn't want to ship goods until they are paid; a buyer doesn't want to pay until goods are shipped. JPMD allows for "Delivery vs. Payment" (DvP). A smart contract can hold the buyer's JPMD and release it to the seller instantly and automatically when a digital Bill of Lading is verified on-chain. No letters of credit, no delays, no trust required.

The Crucial Distinction: Deposit Token vs. Stablecoin

This is the single most important definitional battleground in fintech today. To the casual observer, JPMD and USDC look the same: they are both digital tokens worth $1.00. But under the hood, they are radically different legal and economic instruments.

Stablecoins, specifically non-bank stablecoins like USDT or USDC, are structurally similar to "narrow banks" or money market funds. They (ideally) hold 100% liquid reserves against their tokens. Deposit tokens, however, are built on the fractional reserve banking model.

Feature | Stablecoin (e.g., USDC) | Deposit Token (JPMD) |

Issuer | Private companies (Circle, Tether) | Commercial Bank (JPMorgan Chase) |

Backing | Reserves (Cash, T-bills) | Commercial Bank Deposits |

Structure | "Narrow Bank" (100% reserve) | Fractional Reserve Banking |

Risk Profile | Bearer instrument (Creditor risk) | Bank liability (Deposit risk) |

Regulation | Limited / Evolving | Full Banking Regulation (KYC/AML) |

Insurance | Generally None | Potential Deposit Insurance |

Interest | Rarely passed to holder | Yes (for deposit holders) |

Access | Public / Permissionless | Permissioned (Institutional) |

Use Case | Trading, DeFi, Retail Payments | Institutional Settlement, Treasury |

Why this matters: The Singleness of Money

Regulators are obsessed with the "Singleness of Money." This is the principle that $1 in a bank account should always be exchangeable for $1 in cash or $1 in another bank account, at par, without question.

In a crisis, a stablecoin can de-peg. We saw this with USDC during the Silicon Valley Bank crisis, where it traded at roughly 90 cents on the dollar. That "breakage" creates chaos in the financial system. A commercial bank deposit, due to regulation, capital requirements, and deposit insurance, maintains the singleness of money. JPMD is designed to never break the buck because it is the buck.

Furthermore, stablecoins, in their purest form, drain credit liquidity from the economy. When you buy USDC, that dollar sits idle in a reserve account (or T-bill). It is safe, but it is not being multiplied through the banking system. Because JPMD is a deposit, the bank can lend against it. If a corporate client holds $1 billion in JPMD, JPMorgan can use that deposit base to issue loans to other businesses, fueling economic growth.

The Shocking Pivot: Why Base? Why Public Blockchains?

For a decade, the mantra of Wall Street has been "Blockchain, not Bitcoin" and "Private, not Public." Banks built "walled gardens," private, permissioned blockchains (like the original Onyx or R3's Corda) where everyone was known, trusted, and vetted.

That era just ended.

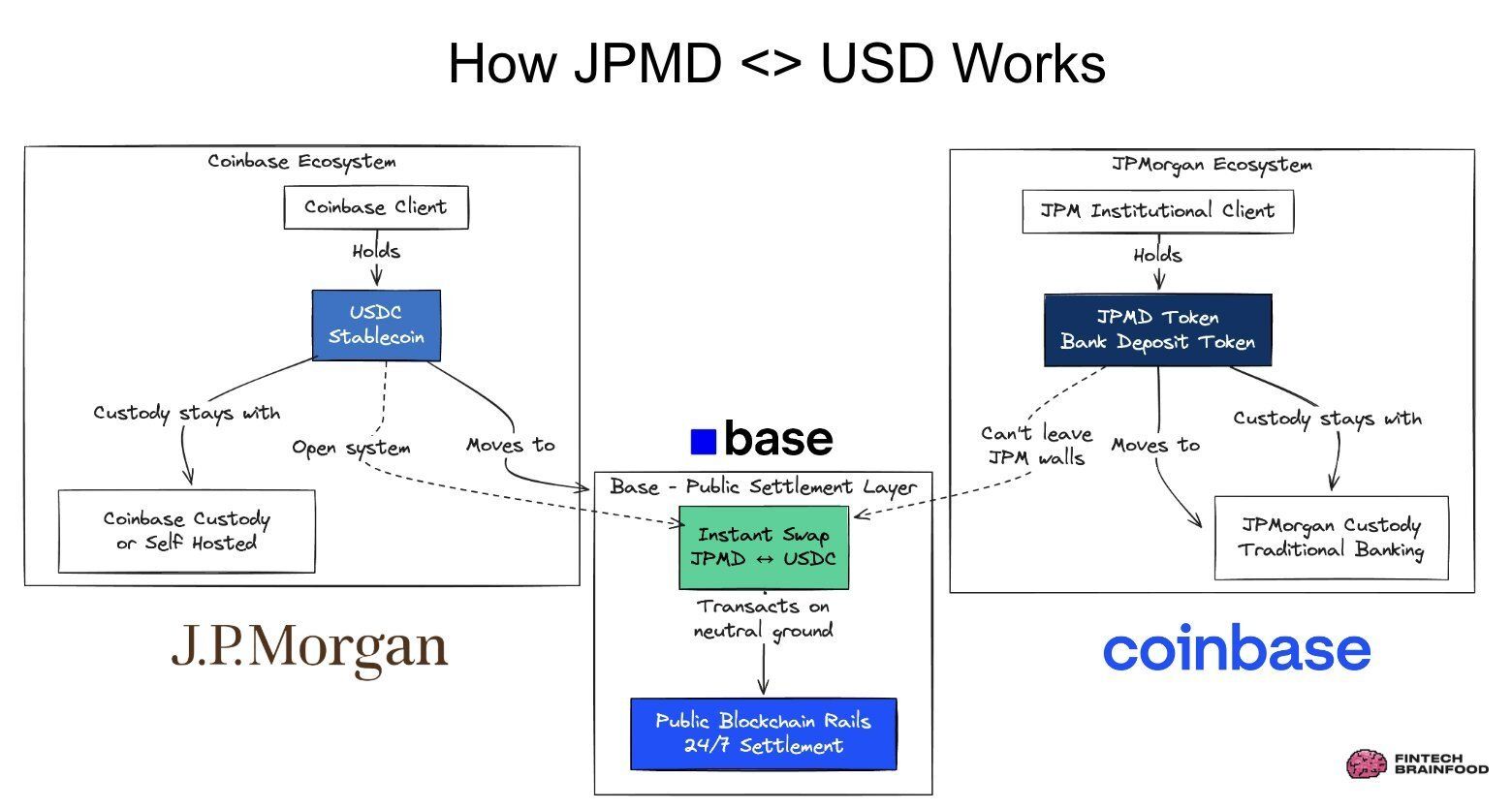

JPMorgan is now testing JPMD on Base, the public Layer 2 blockchain built by Coinbase. This is a stunning reversal. Why would the world's most conservative bank step onto a public rail, exposing its transactions to the "Dark Forest" of the public internet?

The answer is liquidity and composability.

A private blockchain is like a corporate intranet in 1995, safe but isolated. It has no network effects. A public blockchain is the internet. If JPM wants its token to be useful, it needs to go where the users, the developers, and the applications are. They realized that building a perfect private ledger is useless if no one else is on it.

What is a Layer 2 (L2)?

Think of Ethereum (Layer 1) as the main global settlement highway. It is incredibly secure and decentralized, but because everyone uses it, it can get congested and expensive (gas fees).

Base (Layer 2) is an express lane built on top of it. It bundles thousands of transactions into a single batch and settles them down to Ethereum periodically.

Speed: Transactions on Base are near-instant.

Cost: Fees are fractions of a cent.

Security: It inherits the security guarantees of Ethereum.

The Privacy Challenge: Project Mahogany

The biggest hurdle to public blockchains for banks is privacy. JPMorgan cannot have its competitors or the public seeing its clients' trade data on a block explorer. This is where Zero-Knowledge Proofs (ZKPs) come in. JPMorgan has been quietly working on "Project Mahogany" and other privacy solutions. These cryptographic techniques allow a bank to prove a transaction is valid (e.g., "Sender has enough funds") without revealing the details (e.g., "Sender is Company X, Amount is $50M"). This technology is the key that unlocks public chains for private banking.

The Competitive Landscape: The Race for the Unified Ledger

JPMorgan isn't alone. We are seeing a global race to tokenize commercial banking. The "walled gardens" are coming down, and a new, interoperable financial internet is being built.

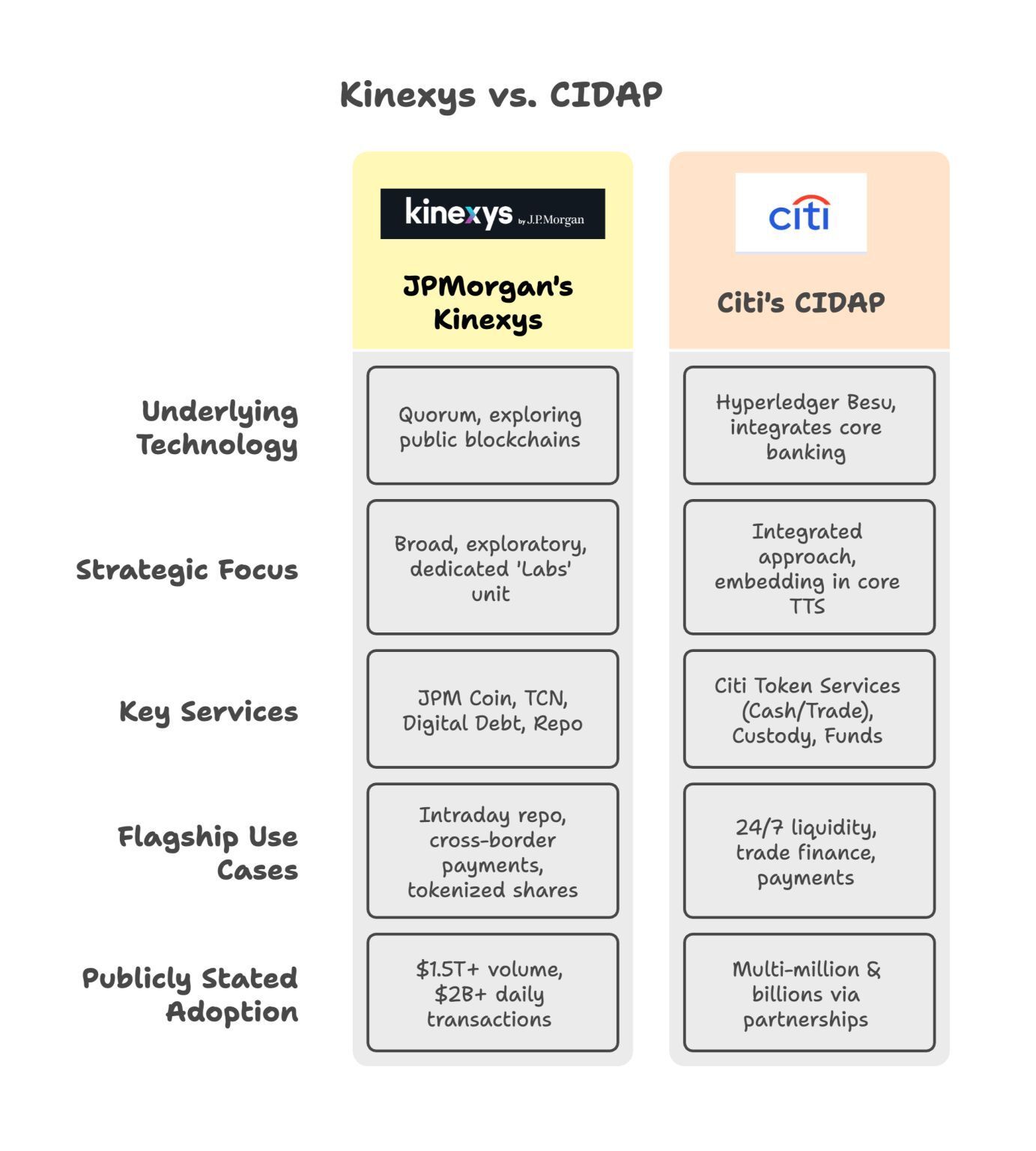

Citi Token Services: Citi is aggressively tokenizing customer deposits to enable 24/7 cross-border transfers and programmable trade finance. Their "Citi Token" creates a similar always-on liquidity network for their massive corporate client base, focusing heavily on trade finance and global shipping.

Société Générale (EURCV): The French giant was one of the first to break the mold, launching its own stablecoin/token on the public Ethereum blockchain. This pioneered the legal framework for using public rails for regulated banking assets in Europe.

The BIS & Project Agorá: The ultimate vision is the "Unified Ledger." The Bank for International Settlements (BIS), often called the central bank for central banks, is leading Project Agorá. This is a massive collaboration with seven central banks (including the NY Fed, Bank of England, and Bank of Japan) to create a shared infrastructure where tokenized commercial bank deposits (like JPMD and Citi Token) can seamlessly interact with tokenized central bank money.

The goal? To create a "Network of Networks." Today, moving money from a JPM account to a Citi account involves a complex messaging web (SWIFT). In the future of Project Agorá, a JPMD token could be swapped for a Citi Token instantly on a unified ledger, with settlement finality provided by the central bank in real-time.

The Future: The Convergence of TradFi and DeFi

We are witnessing the "singularity" of finance. The artificial wall between "Traditional Finance" (TradFi) and "Decentralized Finance" (DeFi) is collapsing. The technology of crypto is being absorbed by the institutions of finance.

My Predictions:

Tokenized Treasury becomes Standard: Within 5 years, every Fortune 500 CFO will use deposit tokens to manage liquidity. The idea of "waiting for Monday" to move cash will seem as archaic as sending a fax. Corporate treasuries will become profit centers, using programmable money to yield farm overnight rates in regulated liquidity pools.

Regulated DeFi Explodes: As banks bring trillions in deposits onto public rails like Base, we will see the rise of "permissioned pools" in DeFi. Imagine an Aave or Uniswap pool that is open only to KYC-verified wallets holding regulated deposit tokens. This unlocks the efficiency of automated market makers (AMMs) for institutional capital, without the compliance risk of interacting with anonymous actors.

The "Crypto" Rebrand: The word "crypto" will likely fade from the institutional lexicon, replaced by "programmable finance," "on-chain banking," or "tokenized deposits." The technology wins, even if the libertarian culture is sidelined.

The Geopolitics of the Dollar: Far from threatening the US Dollar, projects like JPMD strengthen it. We are entering an era of currency competition, where the utility of a currency matters as much as its sovereignty. By creating the most efficient, programmable, and liquid dollar rails in the world, JPMorgan is ensuring that the USD remains the currency of choice for the digital economy. If the Dollar is the easiest currency to program, it will be the currency the world continues to use, countering the rise of non-USD stablecoins or rival CBDCs.

Conclusion

JPMorgan isn't building a competitor to Bitcoin; they are upgrading the US Dollar. By rebranding Onyx to Kinexys and pivoting to public rails, they are admitting that the technology developed by the crypto industry is superior to the legacy banking stack.

The "Jamie Dimon Paradox" is resolved: You can hate the speculation of crypto assets while loving the utility of crypto rails. Kinexys is the proof that the future of money is programmable, efficient, and "always-on," and it will likely be issued by the banks you already trust.