- Synaptic Finance

- Posts

- From Baby Bonds to Tokenised Assets

From Baby Bonds to Tokenised Assets

Trump Accounts and the Future of Childhood Wealth Building

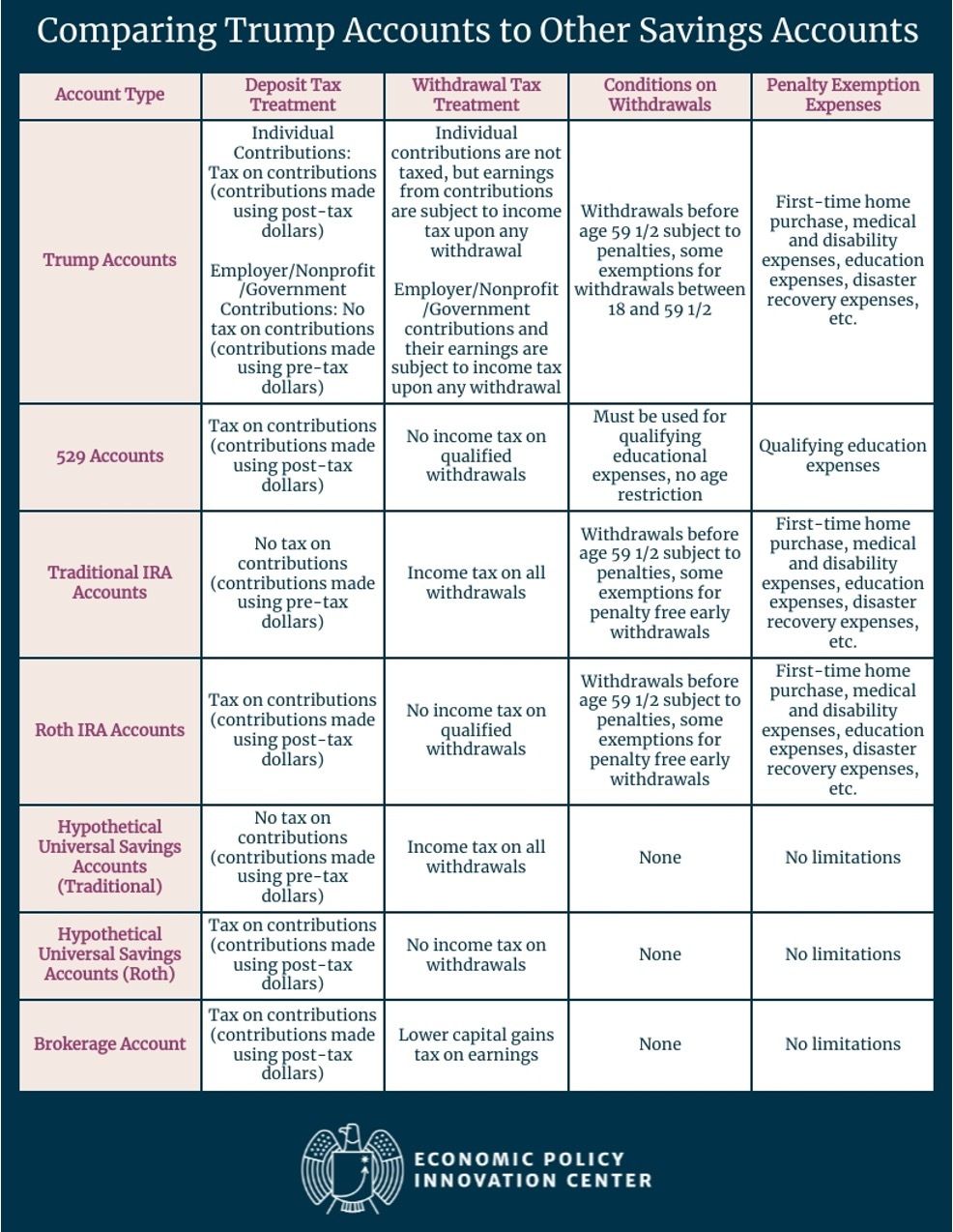

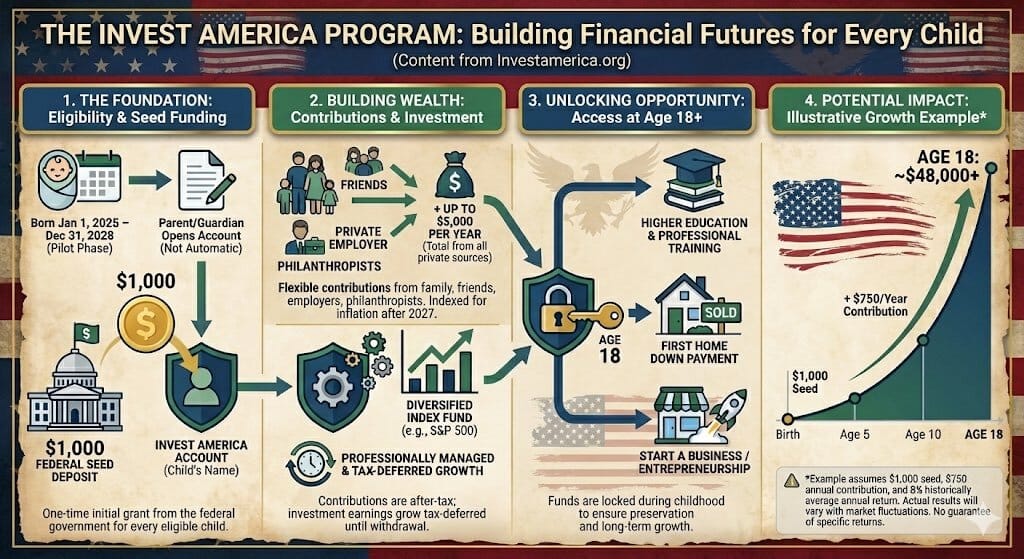

The United States has launched its most ambitious youth wealth-building initiative ever. With $1,000 government-seeded investment accounts for every newborn and a historic $6.25 billion private donation, this program could reshape how Americans, and potentially the world, think about financial inclusion from birth. The Invest America Act, signed into law on July 4, 2025, creates tax-advantaged "Trump accounts" for children under 18, combining government seeding, employer contributions, and philanthropic support in a structure that draws from international models while pioneering new territory.

For platforms like NestiFi, which help families open and manage custodial investment accounts, this legislation creates an entirely new market opportunity. NestiFi plans to offer Trump Accounts through credit unions and community banks, bringing these wealth-building tools to families who may not have relationships with major brokerages.

The Invest America Act Creates a New Financial Asset Class for Children

Senator Ted Cruz (R-TX) introduced the Invest America Act (S. 1718) on May 12, 2025, and its provisions were incorporated into the "One Big Beautiful Bill Act" signed by President Trump on Independence Day. The legislation establishes a new Internal Revenue Code Section 530A, creating investment accounts that function like IRAs but start at birth.

Key features of Trump Accounts:

Feature | Details |

|---|---|

Government seed | $1,000 per eligible child |

Eligible births | January 1, 2025, to December 31, 2028 |

Annual contribution limit | $5,000 (private sources) |

Investment options | Low-cost U.S. equity index funds only |

Maximum expense ratio | 0.10% |

Access age | 18 years old |

Qualified uses | Education, first home, business startup, retirement |

Treasury Department projections illustrate the power of compound growth:

Fully funded ($5,000/year for 18 years): ~$191,000 by age 18

Left untouched until age 60: ~$2.2 million

Dell's $6.25 Billion Donation Extends Coverage to 25 Million Children

On December 2, 2025, Giving Tuesday, Michael and Susan Dell announced one of the largest philanthropic gifts in American history. Their $6.25 billion commitment will provide $250 deposits into Trump accounts for 25 million children age 10 and under who were born before the government seed program's qualifying date.

Dell Gift at a Glance:

Total commitment: $6.25 billion

Per child deposit: $250

Children covered: 25 million (age 10 and under)

Income threshold: ZIP codes with a median household income below $150,000

"The idea is to give millions of children a head start on saving for the future," Michael Dell said at the White House announcement. "We've also talked with a number of other philanthropists, and we feel confident there'll be other significant gifts."

The donation more than doubles the Dell Foundation's total giving since 1999, which previously stood at $2.9 billion. Major corporations, including Uber, Nvidia, Goldman Sachs, Robinhood, T Mobile, and Salesforce, have announced they will contribute to employees' children's accounts, with employers permitted to contribute up to $2,500 per employee annually, tax-free to the recipient.

Employers Gain a New Tool for Family Financial Benefits

The legislation creates IRC Section 128, enabling employers to establish "Trump Account Contribution Programs" with meaningful tax advantages:

Employer Contribution Structure:

Contribution Type | Limit | Tax Treatment |

|---|---|---|

Employer direct contribution | $2,500/employee/year | Excluded from gross income |

Employee salary reduction | $2,500/year | Pre-tax (Section 125 cafeteria plan) |

Combined maximum | $5,000/year | Tax advantaged |

Programs must comply with nondiscrimination rules similar to dependent care assistance, and employers must provide annual statements by January 31.

Early adoption appears modest. A Mercer survey found that only 4% of employers were actively considering contributions, with over one-third deciding against participation. However, Dell Technologies has committed to matching $1,000 for employees' newborns, setting a benchmark for corporate participation.

International Models Demonstrate the Power of Early Asset Building

The Trump account structure draws lessons from successful international programs. These global examples make a compelling case for why every country should implement similar universal youth investment schemes.

Global Youth Investment Programs Comparison:

Country | Program | Annual Limit | Government Contribution | Tax Treatment |

|---|---|---|---|---|

USA | Trump Accounts | $5,000 | $1,000 seed | Tax deferred |

UK | £9,000 | None (CTF ended 2011) | Tax free | |

Canada | No annual limit | 20% match up to C$500/year | Tax deferred | |

Singapore | Varies | $5,000 to $10,000 + matching | Tax free | |

Japan | Junior NISA | ¥800,000 (~$5,300) | None | Tax-free (discontinued 2024) |

South Korea | Youth Hope Savings | ₩500,000/month | Government matching for low-income | Tax advantaged |

The UK's Junior ISAs demonstrate that even without government seeding, tax-advantaged structures drive meaningful participation: £1.8 billion flows into JISAs annually across 1.37 million accounts. Canada's RESP offers the most generous matching at 20%, while Singapore's comprehensive system can provide over $25,000 in government contributions alone.

Japan's Junior NISA (2016 to 2024) and South Korea's Youth Hope Savings show how Asian economies have also recognized the value of early asset building, though these programs have faced various implementation challenges.

Africa: Mobile Money as Financial Inclusion Infrastructure

While not a direct equivalent to Trump accounts, M-Pesa and similar mobile money platforms have revolutionized financial access across Africa, with over 50 million active users. M-Pesa's ecosystem enables families without traditional bank accounts to save for their children's futures. This model offers lessons for how stablecoin-based youth investment accounts could reach the global unbanked population.

Research consistently supports these programs' effectiveness. Kansas University studies found that children with early savings accounts were four times more likely to invest in stocks as adults. The evidence is clear: every nation would benefit from implementing a similar universal youth investment infrastructure.

Current UGMA/UTMA Accounts Offer Flexibility but Limited Tax Benefits

Trump accounts enter a market where custodial accounts already exist but serve different purposes. UGMA (Uniform Gifts to Minors Act) and UTMA (Uniform Transfers to Minors Act) accounts allow adults to transfer assets to minors, but lack the tax advantages and government support of Trump accounts.

UGMA/UTMA Tax Treatment:

Income Level | Tax Treatment |

|---|---|

First $1,350 | Tax free |

$1,351 to $2,700 | Child's tax rate |

Above $2,700 | Parents’ rate ("kiddie tax") |

UTMA accounts can hold virtually any asset type, including real estate and cryptocurrency, though only 48 states have adopted UTMA (South Carolina and Vermont have not).

FAFSA Impact Comparison:

Account Type | Assessment Rate |

|---|---|

UGMA/UTMA | 20% of value |

529 Plan (parent-owned) | 5.64% of value |

Trump Account | TBD (likely favorable) |

The major brokerages, including Fidelity, Schwab, and Vanguard, all offer UGMA/UTMA accounts with zero minimums and zero trading commissions.

Brokerages Prepare for the Trump Account Rollout

All Trump accounts will initially be created and held with Treasury's designated financial agent, not yet publicly identified. Parents can later transfer accounts to preferred brokerages via trustee-to-trustee rollover.

Major Brokerage Positioning:

Brokerage | Strengths | Relevant Experience |

|---|---|---|

Charles Schwab | Educational content, custodial infrastructure | Thrift Savings Plan management |

Vanguard | Low-cost expertise, fee alignment | $185B in 529 plan assets |

Fidelity | Youth account experience | Youth Account (ages 13 to 17), 4 state 529 plans |

The mandated 0.10% expense ratio effectively commoditizes the product, forcing differentiation through user experience, educational tools, and employer integration rather than price.

The Credit Union and Community Bank Opportunity

This is where platforms like NestiFi can compete. Rather than going head-to-head with major brokerages, NestiFi plans to offer Trump Accounts through credit unions and community banks, bringing these wealth-building tools to families who may not have relationships with Schwab, Vanguard, or Fidelity. Credit unions serve over 130 million Americans, and community banks are often the primary financial relationship for rural and underserved communities.

Stablecoins Could Extend Youth Savings to the 1.4 Billion Unbanked Globally

The Trump account framework is designed for traditional banking infrastructure, but the underlying concept could achieve far greater impact through stablecoin-based alternatives.

The Global Unbanked Population:

Total unbanked adults: 1.3 to 1.4 billion globally

Sub-Saharan Africa: 57% unbanked

Asia Pacific: 820 million adults without accounts

Stablecoin transaction volume (2024): $27.6 trillion (exceeding Visa and Mastercard combined)

Yield-bearing stablecoins have grown 13-fold since 2023, reaching approximately $9 billion in assets. Products like BlackRock's BUIDL fund (tokenized Treasury securities) and Ondo Finance's USDY offer conservative yields of 3% to 5% APY that could enhance youth account returns while remaining accessible to unbanked populations.

Combined with mobile money platforms like M-Pesa, stablecoin-based savings could reach billions of families currently excluded from traditional finance.

Tokenization Opens Pathways to Programmable Custodial Accounts

The concept of tokenized custodial accounts represents perhaps the most significant long-term innovation opportunity. Smart contracts on blockchain networks could encode custodian fiduciary duties, age of majority transfer triggers, and tax reporting automation, creating programmable UGMA/UTMA structures with unprecedented transparency.

Current regulations allow UTMA accounts to hold cryptocurrency, though few brokerages support it directly. Trump accounts themselves currently mandate traditional equity index funds only, with no digital assets permitted. However, tokenization could enable:

Collateralized borrowing: Access liquidity against account assets without triggering taxable liquidation events

Real-time portfolio visibility: Transparent tracking for custodians, beneficiaries, and contributing family members

Automated multi-party contributions: Smart contract-enabled deposits from grandparents, employers, and charitable organizations

Programmable restrictions: Incentives encoded for educational achievement or entrepreneurial ventures

Yield generation: Staking or lending account assets while maintaining a custodial structure

The even more transformative layer is the tokenization of the underlying assets themselves. Traditional UGMA and UTMA custodial accounts are irrevocable gifts with broad investment flexibility, yet they remain trapped in legacy brokerage infrastructure. On-chain tokenization changes the game. A tokenized S&P 500 exposure, for example, can be wrapped, staked, or lent in regulated DeFi protocols to generate additional yield, often 4–8% on Ethereum-based staking or 7–10% in conservative stablecoin lending pools, while still preserving the original equity upside.

In the near future, a child’s Trump Account could hold tokenized index funds that automatically earn supplemental yield, or fractional shares of real-world assets (tokenized real estate, private credit, or treasury bonds) that generate passive income long before the beneficiary turns eighteen. Parents could even collateralize a portion of the portfolio against an on-chain education loan without liquidating the core position.

Of course, risks exist: price volatility in the underlying crypto infrastructure, smart-contract vulnerabilities, and custodial concentration. These are being systematically addressed through institutional-grade custodians (Coinbase and Fidelity Digital Assets already run UTMA pilots), insurance funds, and maturing regulatory frameworks such as Europe’s MiCA regime. When managed prudently, the additional yield layer can turn a solid 5–6% equity return into a compounded 9–12% effective return, the difference between a comfortable college fund and genuine generational wealth.

How Digital Infrastructure Supercharges Participation

The combination of stablecoins, digital asset custody, AI, and programmable accounts transforms what childhood wealth policies can achieve. Stablecoins reduce friction for global contributors. AI offers personalised guidance for families, helping them understand investment decisions and automate positive behaviours. Tokenisation expands the available asset universe and improves liquidity. Digital identity frameworks ensure that accounts follow the child throughout life, reducing administrative complexity.

Platforms like NestiFi, which integrate AI coaching, shared family wallets, and multi-asset support, are indicative of the future ecosystem that will surround these accounts. Technology will not replace policy. Instead, it will amplify it.

A New Architecture for Intergenerational Wealth Building

Trump accounts represent more than a tax-advantaged savings vehicle. They signal a philosophical shift toward universal asset ownership from birth. Morningstar analysis suggests progressive "baby bonds" programs "would cut the racial wealth gap in half" in resources available at age 18.

With 3.6 million U.S. births annually and 70+ million children under 18, the addressable market is substantial. Dell's $6.25 billion commitment demonstrates private capital's willingness to amplify government programs.

Whether through traditional brokerages, credit unions, stablecoin platforms, or tokenized smart contracts, the core insight holds: compound growth starting at birth, combined with universal access, could fundamentally alter wealth distribution patterns within a generation.

The infrastructure choices made in the next 24 months will shape how that potential is realized. Platforms building for this future today, NestiFi among them, are positioning themselves at the intersection of policy, technology, and family financial empowerment. By bringing Trump Accounts to credit unions and community banks, these platforms can ensure that America's bold bet on universal youth investment reaches every family, not just those already served by Wall Street.