- Synaptic Finance

- Posts

- Financial LLMs Go Mainstream

Financial LLMs Go Mainstream

War of the Financial LLMs: Who Will Control the Brain of Wall Street?

For the past two years, the financial industry has been quietly amassing its forces. While the world was captivated by generative AI’s creative prowess, a strategic buildup of talent, proprietary data, and computational power was taking place behind the closed doors of Wall Street banks, data behemoths, and AI research labs. This week, the quiet war turned loud. Anthropic's launch of "Claude for Financial Services” was not just another product announcement; it was the starting gun for an open, declared arms race.

This isn't a battle over a single product. It's a war between competing philosophies for building the core intelligence layer of the global financial system. The winner won't just sell software; they will shape how capital is allocated, risk is managed, and advice is given for the next generation. At Synaptic Finance, we see this conflict unfolding across four distinct fronts, with four types of armies vying for dominance. Understanding their strategies, strengths, and weaknesses is crucial for navigating the next decade of financial technology.

A New Taxonomy of Contenders: The Armies in the Field

Four distinct types of contenders are fighting the battle for financial AI supremacy, each with a unique strategic advantage.

1. The AI Generalists (Verticalizing)

These are the frontier AI research labs now adapting their cutting-edge models for finance. Their strategy is to leverage superior reasoning and then fine-tune it with financial data, often through partnerships. Claude-FS, for example, integrates directly with data providers like FactSet, S&P Capital IQ, and Morningstar to stay current. Their analogy is that of building the world's most advanced fighter jets, then adapting them for specific, high-stakes missions.

2. The Data Incumbents (Fortifying the Moat)

These are established giants building models on their exclusive data moats. BloombergGPT is the prime example, trained on a massive "FinPile" dataset of 363 billion financial tokens mixed with 345 billion general text tokens. This immense undertaking required over 1.3 million GPU hours and cost an estimated $2.5-3 million. Their analogy is controlling the world's most valuable fuel depots and building custom engines to run on their exclusive supply.

3. The Sovereign Builders (The In-House Skunkworks)

These are top-tier financial institutions building bespoke models for maximum control. Morgan Stanley, for instance, deployed a GPT-4-powered assistant for its wealth advisors, retrieving information from the firm's own internal knowledge base. Their strategy is driven by the non-negotiable need for security and data privacy. Their analogy is building secret weapons in underground bunkers, tailored perfectly to their own needs.

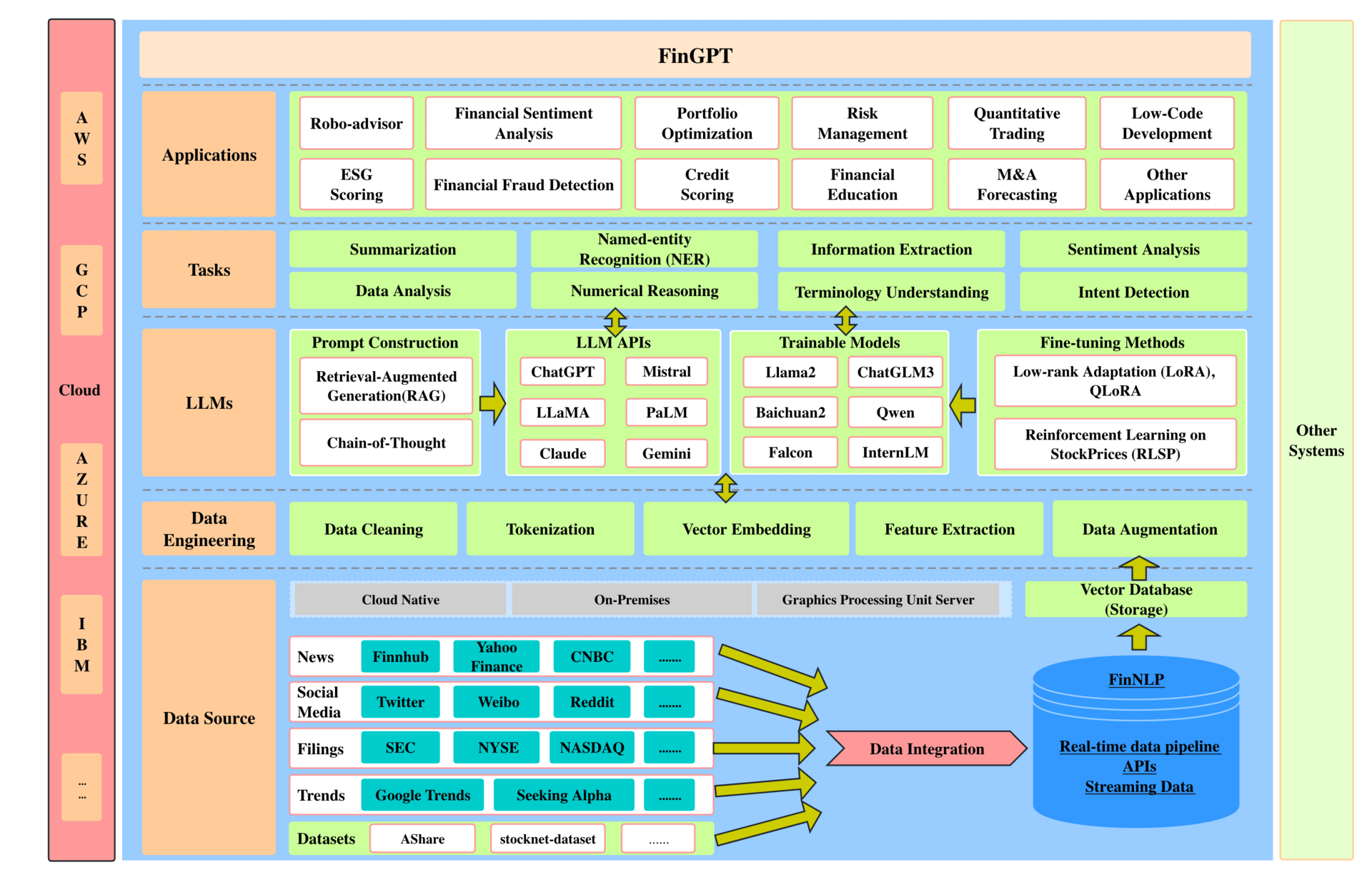

4. The Open-Source Vanguard (The People's Army)

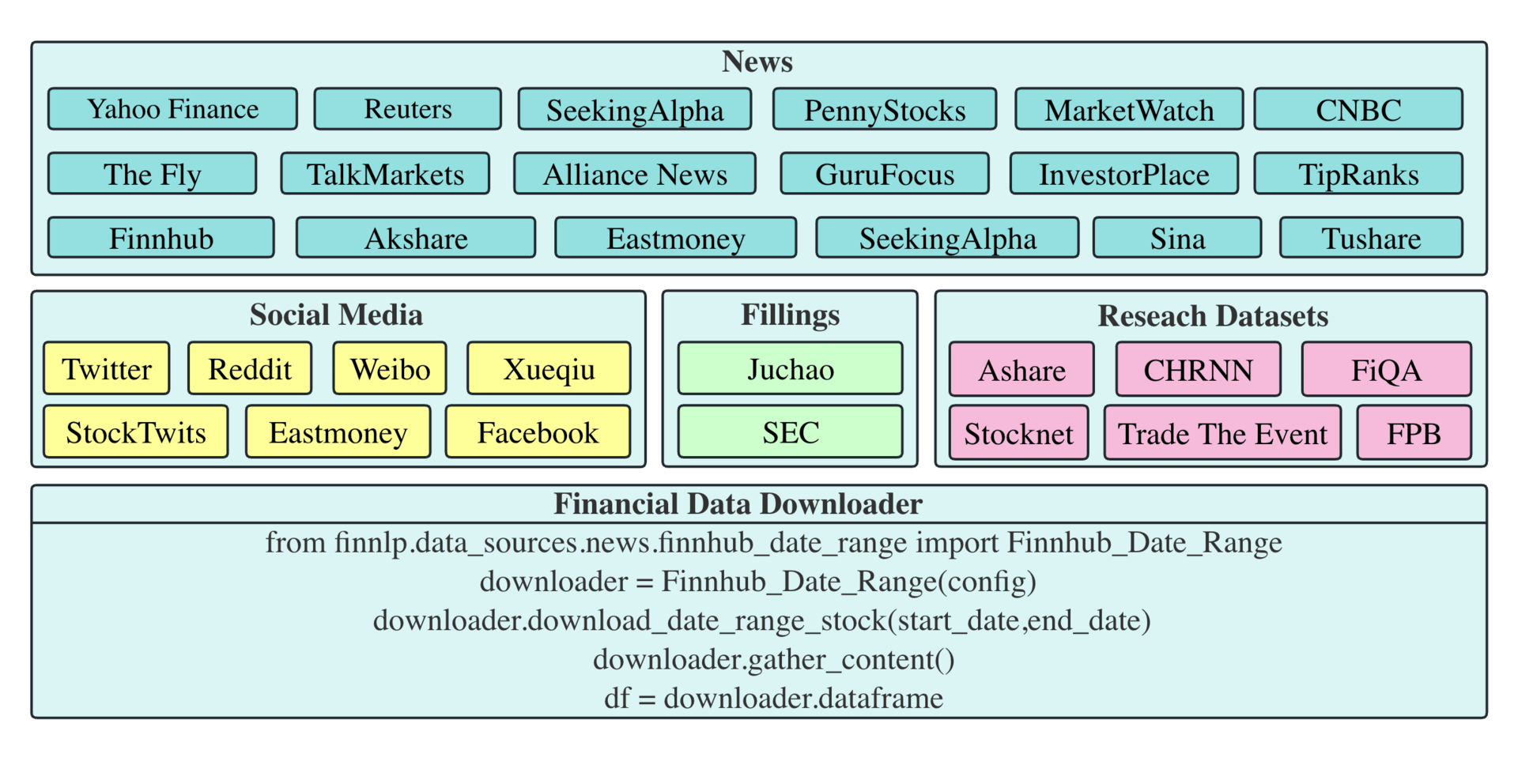

This is the decentralized, community-driven movement building powerful financial LLMs on open-source foundations. Players like FinGPT, InvestLM, and FinLLAMA leverage base models like LLaMA 2 and fine-tune them on financial data using parameter-efficient techniques (PEFT) like Low-Rank Adaptation (LoRA). This data-centric approach, championed by communities like FINOS (Fintech Open Source), allows for rapid, low-cost updates—a model can be fine-tuned on new data for just a few hundred dollars. Their analogy is the global militia, arming developers everywhere with powerful, adaptable rifles that can be customized for any skirmish.

The Battlegrounds: Key Use Cases Where the War is Being Fought

This war is not being fought in a single battle, but across several key fronts, with different contenders holding a strategic advantage in each.

Battleground 1: Alpha Generation & Market Intelligence

This is the holy grail: using AI to find an edge. LLMs can perform real-time sentiment analysis on news, summarize thousands of earnings call transcripts, and identify novel investment signals. BloombergGPT enhances its Terminal functions like search and question answering, while open-source projects like FinGPT-Forecaster are experimenting with AI-driven market predictions.

Who Wins Here? The Data Incumbents have a massive advantage in the institutional space. However, the Open-Source Vanguard will dominate the retail and prosumer market, empowering a new wave of algorithmic trading applications.

Battleground 2: Risk Management & Regulatory Compliance

Financial firms are using LLMs to analyze vast datasets to detect risks, flag suspicious transactions, and explore "what-if" financial scenarios for stress-testing. On the compliance front, these models automate the burdensome process of interpreting regulations. A powerful example is PwC's Regulatory Pathfinder, which uses Claude-FS to break down complex regulations into specific obligations and suggest policy updates for clients.

Who Wins Here? This is a fierce fight between the Sovereign Builders (for internal risk) and the AI Generalists (for interpreting external regulations).

Battleground 3: The Client & Advisor Experience

This is perhaps the largest disruptive battleground. Banks are deploying AI-powered virtual assistants to securely answer account questions and explain products. The Commonwealth Bank of Australia, for instance, is piloting Claude-FS to enhance its customer service and fraud detection. Insurer AIG saw a 5x speedup in processing business insurance applications by embedding Claude into its underwriting workflow.

Who Wins Here? The AI Generalists are the clear favorites for enterprise-grade solutions due to their superior conversational abilities.

Battleground 4: Internal Analytics & The Analyst Co-pilot

Finance professionals are now using LLMs as "co-pilots" for internal data analysis. Bridgewater Associates' AIA Labs created an assistant with Claude-FS that generates Python code and narrative analysis "with the precision of a junior analyst." In a stunning display of capability, an AI agent powered by Claude-FS was able to solve 5 out of 7 expert-level Excel tasks from the Financial Modeling World Cup, achieving 83% accuracy on complex cash flow forecasting and scenario analysis.

Who Wins Here? A tie between the AI Generalists, whose models show incredible reasoning, and specialized platforms like Databricks, whose DBRX model (a 132B parameter Mixture-of-Experts model) excels at enterprise analytics.

The Rules of Engagement: Overcoming the Foundational Challenges

Winning this arms race isn't just about having the best model; it's about solving four fundamental challenges unique to the high-stakes world of finance.

The War on "Hallucinations": An AI fabricating a financial statistic is a catastrophic liability. Specialized benchmarks like FinBench, which uses questions from CFA exams, confirm that even strong models hallucinate on expert topics without proper guardrails. This is why Retrieval-Augmented Generation (RAG), where models like Claude-FS fetch answers from trusted sources like S&P Capital IQ and provide citations, is now a minimum standard for enterprise use.

Fortifying the Gates: Data Security & Privacy: Financial data is among the most sensitive in the world. This creates a strategic dilemma: use a third-party API or build in-house? Anthropic promises not to train on client data by default, but many firms still opt for the ultimate security of a self-hosted model, a key advantage of the open-source movement championed by FINOS.

The Economics of AI: Cost vs. Latency: There is a brutal trade-off between performance and price. Retraining a model like BloombergGPT can cost millions. This creates a huge opening for the FinGPT approach: using efficient fine-tuning techniques (PEFT) to update open-source models on new data for just a few hundred dollars.

The "Black Box" Dilemma: How can a bank satisfy regulators who demand explainability? The transparent nature of open-source models can offer a partial solution, but this remains a critical hurdle for all contenders.

My Prediction: The Emergence of a Stratified AI Ecosystem

My analysis of this conflict leads to one overarching conclusion. There will be no single winner in the financial AI arms race. A single model or company will not "win" finance. Instead, we are witnessing the birth of a stratified and symbiotic AI ecosystem, where each layer of the financial world will come to rely on a different type of AI contender.

The Institutional Core will run on Data and Sovereignty. The top 1% of financial institutions - global banks, hedge funds, and asset managers, will operate on a dual track. For market-facing alpha generation, they will depend on the Data Incumbents like Bloomberg, whose benchmark results on financial NLP tasks are consistently superior to general models of similar size. For their internal, mission-critical risk and compliance functions, they will continue to invest billions in their own Sovereign models.

The Enterprise Layer will be powered by Generalists. The vast majority of financial businesses, regional banks, wealth management firms, insurers like AIG will license their client-facing and advisory technology from the AI Generalists. The safety, reliability, and cutting-edge performance of models like Claude, which have proven their worth in real-world deployments with major banks and on complex benchmarks, will become the "Intel Inside" for the mainstream financial services interface.

The Long Tail of Innovation will be driven by Open Source. A vibrant and highly competitive ecosystem of new fintech applications will be built by the Open-Source Vanguard. This movement, supported by organizations like FINOS and tracked on the Open FinLLM Leaderboard, democratizes access to powerful AI. It will fuel a Cambrian explosion of niche tools for smaller funds, independent advisors, and retail algorithmic traders, who can now fine-tune models like FinGPT for their specific needs at a fraction of the cost of proprietary systems.

The real winner, ultimately, is the financial industry itself. This competition will not lead to a monopoly but to a more diverse, resilient, and technologically advanced market. The productivity gains are already being proven, as Norway's $1.4T sovereign fund reported, a 20% improvement is equivalent to saving over 200,000 hours of human work. The strategic challenge for every leader is no longer if they should adopt AI, but which layer of this new, stratified ecosystem their philosophy and weapons best align with.