- Synaptic Finance

- Posts

- Financial Literacy in the Age of AI

Financial Literacy in the Age of AI

From Static Curricula to Living Systems

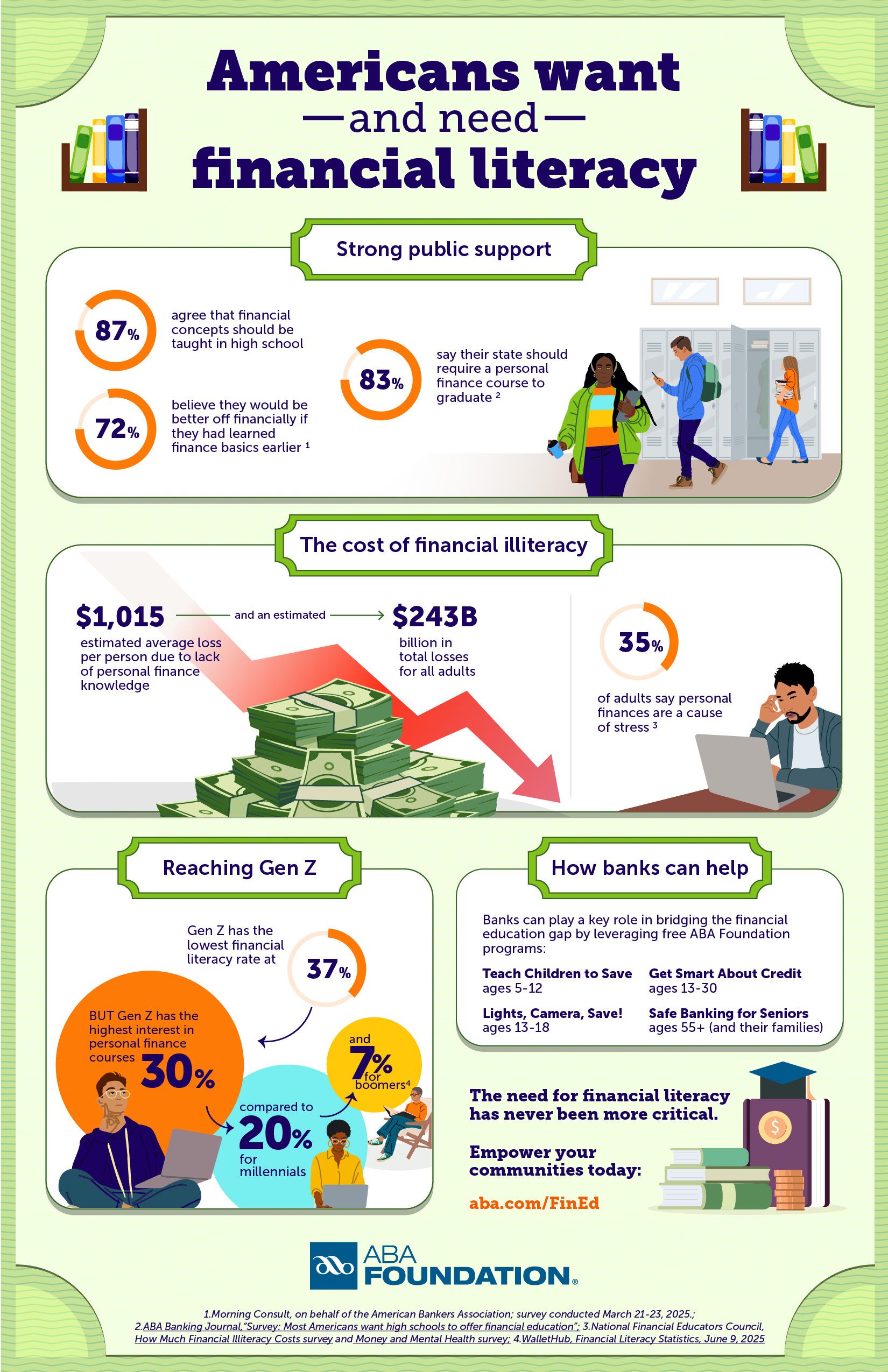

For decades, we have agreed on one thing: financial literacy matters. Governments have created commissions, NGOs have built curricula, and educators have poured thousands of hours into teaching money skills. Yet outcomes remain inconsistent, unevenly distributed, and difficult to personalize at scale. We see the consequences of this stagnation in the most recent data. The 2024 OECD PISA results on financial literacy revealed a startling gap between student confidence and actual capability. While young people are increasingly comfortable with digital platforms, their ability to navigate complex financial trade-offs remains stagnant, particularly in underserved communities. This data serves as a critical baseline, a high-impact infographic of sorts that highlights the urgency of our current moment.

Artificial intelligence changes that equation completely. This is the first moment where financial literacy can move from static content to adaptive, contextual, and continuous guidance, embedded directly into the financial lives of individuals and families. As we navigate 2026, the traditional models of financial education are being upgraded into "living systems”, which are ecosystems that do not just teach finance but experience it alongside the user.

The Landscape: Why Content Alone is No Longer King

To appreciate where we are going, we must briefly look at where we started. For years, the gold standard of financial literacy was defined by robust standards and high-quality curricula. These institutions solved the content problem. They identified the core pillars of financial health: earning, spending, saving, investing, and managing risk. They built standardized frameworks that moved financial literacy from a niche interest to a graduation requirement in many states.

The Institutional Landscape (USA)

Organization | Core Contribution | Strategic Value to Fintech |

National Standards | Provides the "Source of Truth" for what kids need to know. | |

Open-Source Curricula | The gold standard for modern, classroom-ready modules. | |

Teacher Advocacy | Ensures that the educators themselves are financially literate. | |

Policy Alignment | Coordinates the 20+ federal agencies focused on consumer finance. |

The institutional and global landscape has provided the bedrock for this progress. Global efforts have also shown the path forward. Singapore, through its MoneySense program, has pioneered a whole-of-government approach that integrates literacy into the "Smart Nation" infrastructure. This system utilizes SGFinDex to provide the "data fuel" necessary for AI-driven personalization. In the United Kingdom, the Money and Pensions Service (MaPS) focuses on financial well-being as a holistic state. Their research shows that the social aspect is key, and AI can act as a safe, non-judgmental contact for "money talks". Australia's Moneysmart program provides decision-support tools and interactive calculators that serve as precursors to conversational AI tutors.

Program | Country | Core Contribution | Value to AI Systems |

MoneySense | Singapore | Whole-of-government approach | Integrates literacy into infrastructure; SGFinDex provides data fuel. |

MaPS | UK | Financial Wellbeing focus | AI acts as a non-judgmental contact for difficult conversations. |

Moneysmart | Australia | Decision-support tools | Interactive calculators serve as precursors to AI tutors. |

However, in a world where global markets move at sub-millisecond speeds, a "Map" is no longer enough. We have entered an era where users need real-time navigation. The traditional model relied on "just-in-case" education - teaching a teenager about a mortgage they won't sign for a decade. The AI model offers "just-in-time" agency, delivering specific intelligence exactly when a decision is being made.

The Fintech Evolution: From Transactional to Autonomous

For the last decade, Fintech was about access. We built apps that made it easier to open an account, trade a stock, or send money. This was the "Neo-bank" era. While it lowered barriers, it didn't necessarily increase intelligence. It gave everyone a car, but it didn't provide everyone with a driver's license. In 2026, Fintech is shifting from Transactional Finance to Autonomous Finance.

The Three Waves of Fintech Development

The Utility Era: Digitizing physical banks and mobile access. Education was restricted to static PDFs or FAQ sections.

The Integration Era: Connecting spending to saving via APIs. Education consisted of basic budgeting charts and graphs.

The Intelligence Era: Powered by Large Language Models (LLMs) and AI Agents. Education becomes a Living System - proactive, conversational, and integrated.

AI-driven Fintech isn't just about moving money; it's about interpreting it. We are seeing a global shift where financial tools are becoming "context-aware".

The Power of AI: Turning Data into Dialogue

The true breakthrough of AI in this space is Natural Language Processing (NLP). Financial jargon has historically acted as a gatekeeper. Terms like "fiduciary," "amortization," and "escrow" are alienating. AI acts as a Universal Translator. It can take a 60-page credit card agreement and, in seconds, summarize the three things that will actually cost the user money. It transforms "bank-speak" into "human-speak".

The Duolingo Effect: Habits Over Homework

If we want to see the future of financial education, we look at Duolingo. They didn't make people learn languages by having them read a textbook. They used AI to create a gamified, habit-forming "edutainment" loop. In the AI age, financial literacy follows this model:

Micro-Interactions: Finance isn't a 45-minute lecture; it's a 30-second interaction when you're about to make a purchase.

Predictive Scaffolding: The AI knows what you already understand. If you've mastered "saving," it won't bore you with the basics; it will challenge you with "inflation-protected assets".

Emotional Support: AI doesn't judge. It provides a psychologically safe space for learning.

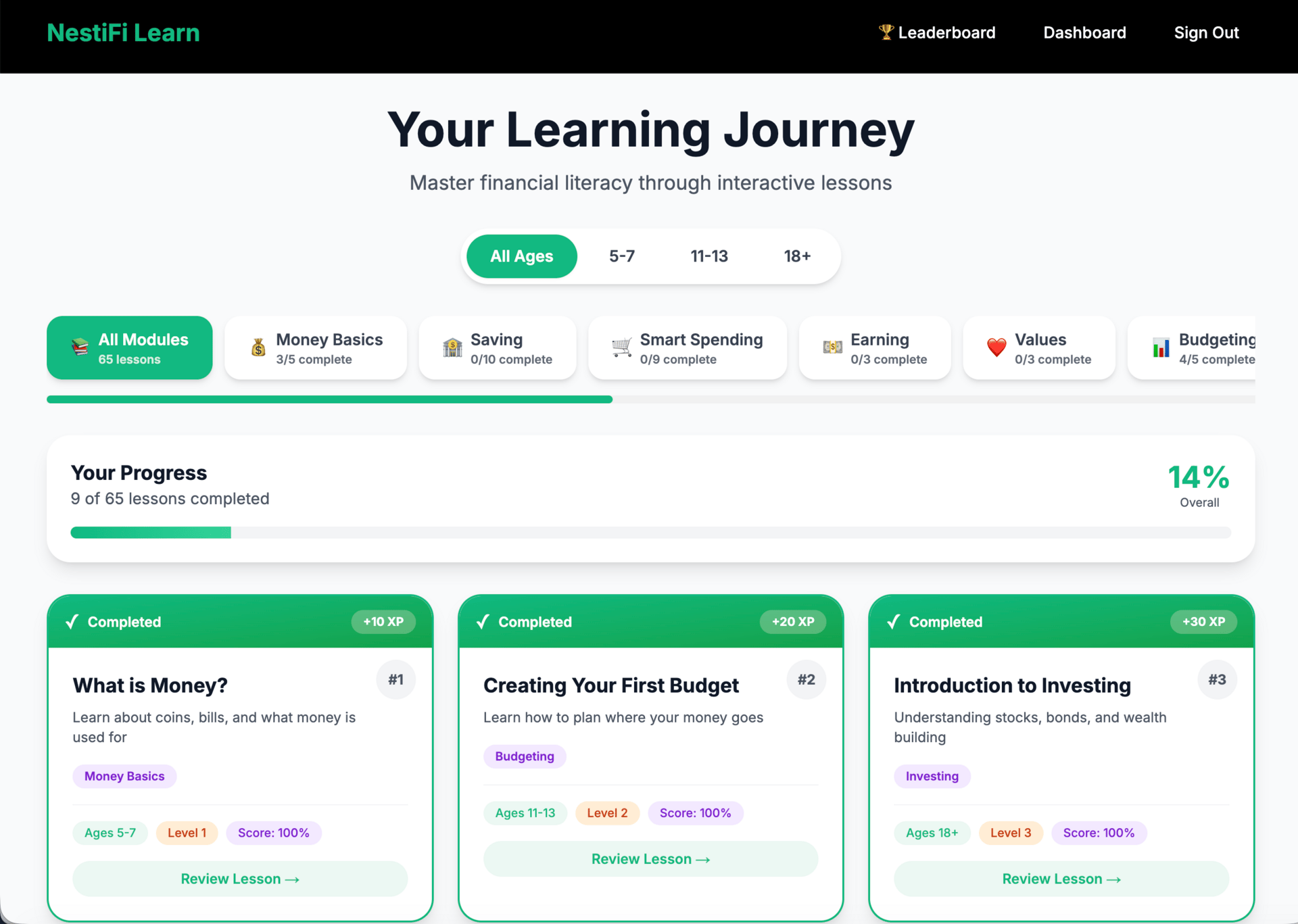

NestiFi & Seb: The Vision for Financial Agency

At NestiFi, we believe that the ultimate form of financial inclusion is the democratization of high-level advice. Historically, if you were wealthy, you had a "Family Office" - a team of humans to guide you. If you were not, you were on your own. We are building Seb, an AI agent designed to be a "Family Office for everyone". Seb is a Personal Financial Tutor who grows with the user.

What Seb Represents for the Future

Proactive Mentorship: Instead of waiting for you to ask a question, Seb is designed to "nudge" you. If a global economic event impacts your holdings, Seb explains it in your language.

Interactive Lessons: Seb manages digital goals. For a child, Seb might manage an allowance, teaching "opportunity cost" by showing how buying a toy today delays buying a console next month.

Contextual Safety: Seb understands your goals. If you are saving for a home, Seb's "curriculum" focuses on credit scores and mortgage types - delivered in bite-sized pieces over your journey.

The Future: AI and Hyper-Personalization at Scale

As we look toward 2026 and beyond, the very concept of a "financial literacy syllabus" will become obsolete. AI allows for Hyper-Personalization at Scale.

1. Generative Financial Scenarios

The future of learning is simulation. AI will allow users to "stress-test" their lives. "Seb, show me what happens to my savings if I lose my job for three months while interest rates are at 6%". The AI won't just give a number; it will create an interactive lesson on "emergency funds" based on the user's actual life data.

2. Multi-Modal Guidance

The keyboard is disappearing. The future of financial literacy is voice and vision. Imagine a young person looking at a car on a lot, putting on AR glasses, and having their AI agent overlay the "Real Cost of Ownership" (including insurance and maintenance) over the sticker price.

3. Predictive Inclusion

AI can identify "Financial Deserts" before they happen. By analyzing spending patterns in real-time, AI agents can proactively reach out to underbanked individuals with educational modules on how to improve their standing.

A Wake-Up Call for Fintech Innovators

To those building in the Fintech space: Utility is no longer your competitive advantage. In the early 2020s, being "fast" and "cheap" was enough. Today, that is the baseline. The real differentiator in the next five years will be Intelligence Equity. We must stop treating "Financial Education" as a marketing gimmick. It must be baked into the Agentic Workflows of our products. When a user interacts with a bank, the "Educational Layer" should be as seamless as the "Transactional Layer".

Scaling the Future: The Behavioral Shift

The transition from static to living systems isn't just a technical upgrade; it's a psychological one. We are moving from a world where finance is something you do (occasionally and with stress) to something that flows (continuously and with support). This shift requires us to rethink the "Learning Journey". In the old model, the journey ended with a certificate. In the AI model, the journey is lifelong. The AI grows with you - it knows that the lessons you need as a first-time parent are different from the lessons you needed as a first-time employee.

The Integrity of the AI Tutor

As we build these living systems, we must rely on the research-backed foundations provided by FLEC and the Council for Economic Education. Technology is the delivery vehicle, but the principles of sound finance remain the cargo. Our AI models must be trained on verified financial science to ensure that "Financial Agency" doesn't turn into "Automated Misinformation".

Looking Ahead: The NestiFi Beta

At NestiFi, we are obsessed with the transition from knowledge to wisdom. While Seb represents our long-term vision for a proactive financial companion, we are already laying the groundwork for how humans interact with digital-first finance lessons. We have launched a free learning tool at learn.nestifi.money.

It is important to understand that this tool is still in its beta testing phase. It is an experimental laboratory where we are exploring how to break down complex institutional knowledge into the "edutainment" format that modern users expect. We aren't looking to replace the classroom; we are looking to see how we can supplement it with technology that feels as intuitive as a conversation. By gathering feedback on this beta tool, we are refining the pedagogical logic that will eventually power Seb's interactive capabilities.

Conclusion: The New Era of Financial Freedom

Financial literacy is the final frontier of the civil rights movement in the digital age. Without the knowledge to navigate the modern economy, "access" to finance is a hollow promise. For decades, we have been limited by the physical constraints of the classroom and the static nature of the textbook. AI has broken those constraints.

We now have the ability to give every human being on the planet - regardless of their wealth or location - a private financial tutor that never sleeps and never judges. The work of the last 30 years from institutions like Jump$tart and NGPF has given us the data. The Fintech revolution has given us the infrastructure. Now, with AI agents, we have the chance to create Financial Agency for all. The future of finance is not just about being "unbanked" or "banked". It's about being empowered. It's time to move from teaching people about money to giving them the intelligence to master it.