- Synaptic Finance

- Posts

- Build Your Own Blockchain (BYOB)

Build Your Own Blockchain (BYOB)

Why Leading Companies Want Their Own Ledgers

This week, the strategic direction of Web3 took a sharp turn. Circle formally announced its 'Arc' blockchain, while credible media reports suggest payments giant Stripe is developing its own, codenamed 'Tempo'. This isn't a coincidence. It's a seismic shift in strategy, marking the end of the 'one-chain-to-rule-them-all' era and the beginning of the age of the sovereign enterprise. For years, the promise of Web3 was a single, unified financial layer built on general-purpose chains like Ethereum. The idea was that businesses would become tenants, building their applications on this shared, global infrastructure. But the recent flurry of announcements from a diverse set of industry leaders, from financial giants like Stripe and Circle to consumer platforms like Robinhood and even global brands like FIFA, signals a profound change in thinking.

This trend is not about companies abandoning the principles of Web3. It is the logical next step in its maturation. The goal is to move from being a tenant on someone else's platform, subject to their rules, congestion, and economics, to owning the core infrastructure for their own digital economy. In the 90s, every company built a website. In the 2010s, every company built an app. We are now entering a phase where leading financial and consumer brands are strategically choosing to build their own blockchains.

Introducing Arc, the home for stablecoin finance.

@arc is an open Layer-1 blockchain purpose-built to drive the next chapter of financial innovation powered by stablecoins.

Designed to provide an enterprise-grade foundation for payments, FX, and capital markets, Arc delivers

— Circle (@circle)

12:34 PM • Aug 12, 2025

The "Why Now?" Moment: The Cambrian Explosion of Blockchain Toolkits

This strategic migration has been made possible by a quiet but powerful revolution in the underlying technology. Just a few years ago, launching a new blockchain was an impossibly expensive and complex R&D project, reserved for only the most well-funded, crypto-native teams. Today, that has fundamentally changed. We are in the midst of a Cambrian explosion of blockchain development frameworks that have democratized the ability to create custom, high-performance chains.

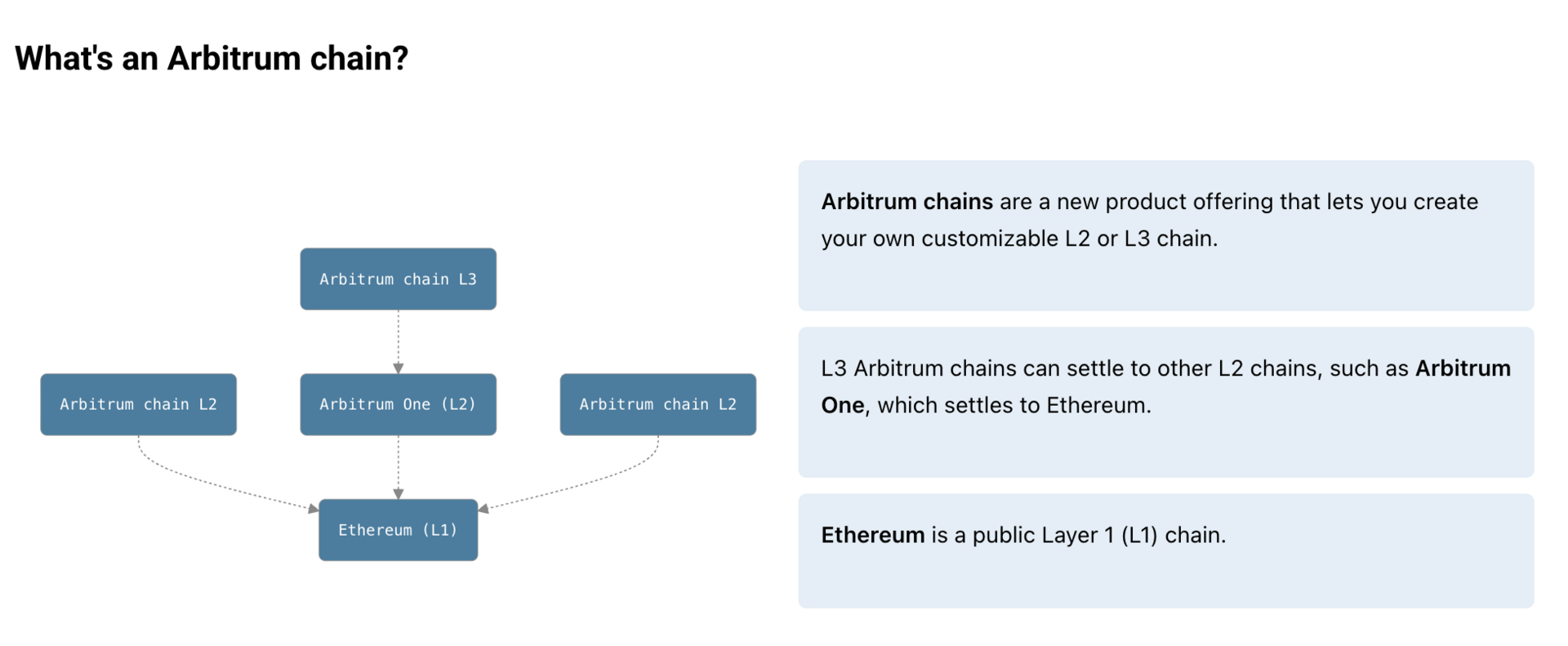

The primary enablers of this shift are modular blockchain frameworks. These are essentially "blockchain-in-a-box" toolkits that allow developers to construct their own custom chains by selecting from a menu of pre-built components. The most prominent of these are the so-called "chain stacks" that allow for the creation of Layer 2 (L2) blockchains that inherit the security of a robust base layer like Ethereum. Toolkits like the OP Stack, the Polygon Chain Development Kit (CDK), and Arbitrum Orbit have dramatically lowered the barrier to entry. They handle the most complex parts of building a blockchain, like the consensus mechanism and data availability, allowing companies to focus on customizing the parts that matter most to their business.

This has been accelerated by the emergence of Rollups-as-a-Service (RaaS) platforms. Companies like Caldera and Conduit have taken these modular frameworks and turned them into a simplified, cloud-like deployment service. They have transformed the process of launching a blockchain from a multi-year engineering challenge into something that can be configured and deployed in a matter of weeks, or even days. This technological leap is the critical "why now" that has unlocked the strategic floodgates for mainstream companies.

Deep Dive: Strategic Moves and Their Ripple Effects

The decision to build a proprietary blockchain is not a technological one. It is a deeply strategic one. By examining the recent moves from key players, we can see the new competitive moats being built in real-time.

Circle’s Arc: A Stablecoin Empire Ascendant

Circle’s Arc shows the future: vertical integration, total control from issuance (USDC) to settlement (Arc). Sub-second finality, built-in FX, and privacy engines. Circle is not just moving money. It is building a programmable digital dollar ecosystem with global reach. Why does this matter? Because it allows Circle to design the rules for stablecoin adoption, set standards for compliance and cross-border settlement, and further entrench USDC as the dollar of the internet. Arc’s real endgame is an infrastructure play for governments, banks, and payment firms who want to bridge fiat and crypto without the performance headaches of public chains.

My prediction: Arc will become one of the leading chains for enterprise stablecoin rails, especially as CBDCs and regulated digital currencies emerge.

Stripe’s Tempo: Programmable Payments 2.0

Stripe building Tempo is not just about rebranding blockchain. It is a bid to own programmable payments at web scale. Stripe can optimize for microtransactions, cross-border remittances, and merchant payout schedules that public chains simply were not designed to handle. This is what crypto needs: a real business case for blockchains as back-end plumbing, not speculative casinos. With Stripe’s legion of developers and business clients, Tempo could quickly become the rails for millions of global transactions. If Stripe integrates with DeFi liquidity and lending, expect explosive new products at the intersection of traditional and crypto payments.

My prediction: Stripe will make Tempo the backbone for embedded finance and next-gen API payment flows, setting the new standard for enterprise blockchain usability.

New Layer 1s face off.

While @circle's Arc and @stripe's Tempo L1s target stablecoin rails, the lasting share will be won by utility and cost advantage—not branding.

We think Arc and Tempo will compete where high-throughput, low-fee USDC payments are most relevant to users.

— Coinbase Institutional 🛡️ (@CoinbaseInsto)

10:00 PM • Aug 15, 2025

Robinhood: The Bridge Between TradFi and DeFi

Robinhood is not just “going crypto”. It is completely reimagining asset ownership. This is not just about trading Bitcoin or Ethereum. It is about buying and holding shares in SpaceX or OpenAI, 24/7, on-chain, in fractions, with instant settlement. The tokenization of traditional assets is the biggest “unlock” since index funds. By building its own chain, Robinhood can strip away legacy friction, open up global access, and potentially create entirely new liquid markets for private company shares and alternative assets.

Prediction: Robinhood’s blockchain will disrupt everything from brokerage, ETFs and even retirement accounts, leading institutional incumbents to race to launch their own chains.

You didn’t think we’d just announce new products, did you?

The Robinhood Chain is currently being built on @arbitrum to power the future of asset ownership.

#RobinhoodPresentsrbnhd.co/ToCatchaToken

— Robinhood (@RobinhoodApp)

3:34 PM • Jun 30, 2025

FIFA: Digital Fandom at Billion-Person Scale

FIFA’s blockchain vision is about more than collectibles. It is about creating programmable “fan identity,” digital access passes, voting rights, and new games. Sports is the ultimate battleground for emotional engagement, and blockchain finally offers the tech to make fans digital shareholders in their teams and tournaments. Interoperability with Avalanche means FIFA can plug into existing crypto communities, but its own chain lets it create tailored, branded experiences.

My prediction: I expect other leagues such as the NFL, NBA, and Tennis to follow suit.

Tether’s Plasma: Stablecoin Wars Accelerate

The launch of Plasma, a blockchain purpose-built for Tether’s USDT stablecoin, is one of the most disruptive stablecoin developments. Plasma promises zero-fee USDT transfers with Bitcoin-level security, significantly challenging Ethereum and Tron, which currently handle the majority of stablecoin volumes. Plasma’s $373 million oversubscribed token sale and $1 billion launch liquidity demonstrate strong investor confidence. By focusing exclusively on stablecoins and streamlining operations, it is poised to become the new standard for frictionless digital dollar transfers.

The Inevitable Challenges: Sovereignty Comes at a Price

While the strategic benefits are compelling, building a proprietary blockchain is not a panacea. It comes with its own significant set of risks and trade-offs that every company must carefully consider.

The Security Burden: While L2s inherit the cryptographic security of their base layer, the company is now responsible for the security and uptime of its own critical infrastructure. The sequencer, which is responsible for ordering transactions on an L2, is a critical point of failure. A malicious attack or technical failure of the sequencer could bring the entire chain to a halt.

Interoperability & Fragmentation: The biggest risk of this trend is the potential to create a fragmented landscape of thousands of disconnected "blockchain islands." If a user's assets on Stripe's Tempo chain cannot easily be moved to Circle's Arc chain or a decentralized application on another L2, it could create a confusing and inefficient user experience, undermining the core promise of a seamless, interoperable Web3.

The "Ghost Town" Risk: The single hardest part of building a new platform is attracting developers and users. If you build a new blockchain, you are also responsible for building its entire ecosystem from scratch. This includes providing developer tools, documentation, and incentives to convince builders to invest their time and resources in your proprietary ecosystem. Without a vibrant community of developers and users, even the most technologically advanced chain can quickly become a ghost town.

My Take: The Future is a "Network of Networks"

I believe we are witnessing a natural and necessary evolution. The future of the internet will not be a single decentralized chain, nor will it be a return to the centralized walled gardens of Web2. Instead, it will be a "network of networks", a constellation of thousands of interconnected, sovereign blockchains, each tailored to its own specific community or application.

The strategic imperative for companies like Stripe, Circle, and Robinhood is clear: they must own their own destiny by building their own sovereign rails. However, their long-term success will not be determined by the quality of their individual chains alone. It will be determined by their ability to connect to the broader ecosystem. The most valuable companies of the next decade will be those that not only build their own sovereign chain but also master the art of building secure and seamless bridges to others. The future is not about building islands. It is about building the best ports and trade routes in a new, decentralized world.

Conclusion: The Next Wave of Infrastructure

The "Build Your Own Blockchain" trend is the logical evolution for any scaled digital business. It represents a strategic shift from being participants in an ecosystem to becoming the architects of their own. The maturation of modular frameworks and RaaS platforms has made this possible, and the strategic drivers of economic control, user experience, performance, and compliance have made it necessary.

While the challenges are significant, the direction of travel is clear. Building a proprietary blockchain will soon be as fundamental to a company's digital strategy as having a website was in the 90s or a mobile app was in the 2010s. We are at the very beginning of this next great wave of infrastructure development, and the companies that are moving now are laying the foundation for the next era of the internet.